The year 2018 is nearing of its end, and for FINRA member firms and broker-dealers, this is now the best time to look back and evaluate the processes and systems they have implemented for the past 12 months in order to comply with FINRA retention requirements.

In order to help you evaluate if your FINRA compliance efforts are sufficient for its electronic communications rules, here is the continuation of our 1st blog post, where we will detail the non-compliance cases with FINRA retention requirements as well as the charges and penalties levied for the 2nd half of 2018.

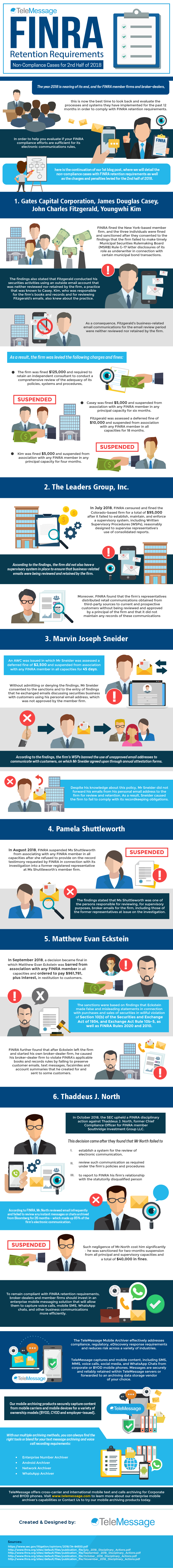

1. Gates Capital Corporation, James Douglas Casey, John Charles Fitzgerald, Youngwhi Kim

1. Gates Capital Corporation, James Douglas Casey, John Charles Fitzgerald, Youngwhi Kim

FINRA fined the New York-based member firm,and the three individuals were fined and sanctioned after they consented to the findings that the firm failed to make timely Municipal Securities Rule making Board (MSRB) Rule G-17 letter disclosures of its role as underwriter in connection with certain municipal bond transactions.

The findings also stated that Fitzgerald conducted his securities activities using an outside email account that was neither reviewed nor retained by the firm, a practice that was known to Casey. Kim, who was responsible for the firm’s books and records and for reviewing Fitzgerald’s emails, also knew about the practice. As a consequence, Fitzgerald’s business-related email communications for the email review period were neither reviewed nor retained by the firm.

As a result, the firm was levied the following charges and fines:

- The firm was fined $125,000 and required to retain an independent consultant to conduct a comprehensive review of the adequacy of its policies, systems and procedures,

- Casey was fined $5,000 and suspended from association with any FINRA member in any principal capacity for six months. Fitzgerald was assessed a deferred fine of $10,000 and suspended from association with any FINRA member in all capacities for 18 months.

- Kim was fined $5,000 and suspended from association with any FINRA member in any principal capacity for four months.

2. The Leaders Group, Inc.

In July 2018, FINRA censured and fined the Colorado-based firm for a total of $95,000 after it failed to establish, maintain, and enforce a supervisory system, including Written Supervisory Procedures (WSPs), reasonably designed to supervise representative’s use of consolidated reports.

According to the findings, the firm did not also have a supervisory system in place to ensure that business-related emails were being reviewed and retained by the firm. Moreover, FINRA found that the firm’s representatives distributed retail communications obtained from third-party sources to current and prospective customers without being reviewed and approved by a principal of the firm and that it did not maintain any records of these communications

3. Marvin Joseph Sneider

An AWC was issued in which Mr Sneider was assessed a deferred fine of $2,500 and suspended from association with any FINRA member in all capacities for 45 days. Without admitting or denying the findings, Mr Sneider consented to the sanctions and to the entry of findings that he exchanged emails discussing securities business with customers using his personal email address, which was not approved by the member firm.

According to the findings, the firm’s WSPs banned the use of unapproved email addresses to communicate with customers, on which Mr Sneider agreed upon through annual attestation forms. Despite his knowledge about this policy, Mr Sneider did not forward his emails from his personal email address to the firm for review and retention. As a result, Sneider caused the firm to fail to comply with its recordkeeping obligations.

4. Pamela Shuttleworth

In August 2018, FINRA suspended Ms Shuttleworth from associating with any FINRA member in all capacities after she refused to provide on-the-record testimony requested by FINRA in connection with its investigation into a former registered representative at Ms Shuttleworth’s member firm.

The findings stated that Ms Shuttleworth was one of the persons responsible for reviewing, for supervisory purposes, broker emails for the firm, including those of the former representatives at issue on the investigation.

5. Matthew Evan Eckstein

In September 2018,a decision became final in which Matthew EvanEckstein was barred from association with any FINRA member in all capacities and ordered to pay $961,781, plus interest, in restitution to customers. The sanctions were based on findings that Eckstein made false and misleading statements in connection with purchases and sales of securities in willful violation of Section 10(b) of the Securities and Exchange Act of 1934, and Exchange Act Rule 10b-5, as well as FINRA Rules 2020 and 2010.

FINRA further found that after Eckstein left the firm and started his own broker-dealer firm, he caused his broker-dealer firm to violate FINRA’s applicable books and records rules by failing to preserve customer emails, text messages, facsimiles and account summaries that he created for and sent to some customers.

6. Thaddeus J.North

In October 2018, the SECupheld a FINRA disciplinary action against Thaddeus J. North, former Chief Compliance Officer for FINRA member Southridge Investment Group LLC.

This decision came after they found that Mr North failed to (i) establish a system for the review of electronic communication, (ii) review such communication as required under the firm’s policies and procedures and (iii) to report to FINRA his firm’s relationship with the statutorily disqualified person.

According to FINRA, Mr.North reviewed email infrequently and failed to review any instant messages or chats archived from Bloomberg for 26 months – which made up 85% of the firm’s electronic communication. Such negligence of Mr.North cost him significantly – he was sanctioned for two-months suspension from all principal and supervisory capacities and a total of $40,000 in fines.

To remain compliant with FINRA retention requirements, broker-dealers and member firms should invest in an enterprise mobile messaging solution that will allow them to capture voice calls, mobile SMS, WhatsApp chats, and other business communications more efficiently.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, eDiscovery response requirements and reduces risk across a variety of industries. TeleMessage captures and mobile content, including SMS, MMS, voicecalls, social media, and WhatsApp Chats from corporate or BYOD mobile phones. Messages are securely and reliably retained within TeleMessage servers or forwarded to an archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD and employer-issued). With our multiple archiving methods, you can always find the right tools or blend for your text message archiving and voice call recording requirements:

TeleMessage offers cross-carrier and international mobile text and calls archiving for Corporate and BYOD phones. Visit www.telemessage.com to learn more about our enterprise mobile archiver’s capabilities or Contact Us to try our mobile archiving products today.