Many firms have lapses in monitoring various transactions, resulting in multiple fines. The year 2019 has seen the least number of cases brought since 2011. Among the industry’s key enforcement issues are the firms that are lacking Anti Money Laundering programs, adequate supervisory systems regarding exchange-traded funds and products, the spreading of misleading information, failures to address municipal short positions, and failures in supervising early Unit Investment Trust rollovers.

Many people in the industry committed various criminal acts resulting in different firms getting fined for lacking the necessary data protection measures to supervise employee communications. Being incapable of monitoring electronic conversations opens up compliance risks with people scamming others and spreading misinformation.

The infographic shows FINRA enforcement trends for 2020 and the statistics according to Eversheds Sutherland’s annual analysis. Financial firms and broker-dealers can also see the new and ongoing areas of focus to enhance their compliance, supervisory, and risk management programs.

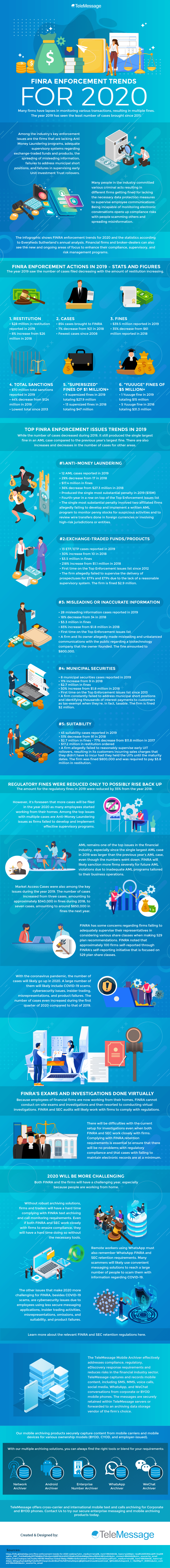

FINRA Enforcement Actions in 2019 – Stats and Figures

The year 2019 saw the number of cases filed decreasing with the amount of restitution increasing.

- Restitution

- $28 million in restitution reported in 2019

- 8% increase from $26 million in 2018

- Cases

- 854 cases brought to FINRA

- 7% decrease from 921 in 2018

- Fewest cases since 2008

- Fines

- $39.5 million reported in 2019

- 35% decrease from $61 million reported in 2018

- Total Sanctions

- $70 million total sanctions reported in 2019

- 44% decrease from $124 million in 2018

- Lowest total since 2013

- “Supersized” Fines of $1 million+

- 9 supersized fines in 2019 totaling $27.9 million

- 13 supersized fines in 2018 totaling $47 million

- “Yuuuge” Fines of $5 million+

- 1 Yuuuge fine in 2019 totaling $15 million

- 5 Yuuuge fine in 2018 totaling $31.3 million

Top FINRA Enforcement Issues Trends in 2019

While the number of cases decreased during 2019, it still produced the single largest fine in an AML case compared to the previous year’s largest fine. There are also increases and decreases in the number of cases for other areas.

#1: Anti-money Laundering

- 12 AML cases reported in 2019

- 29% decrease from 17 in 2018

- $17.4 million in fines

- 36% decrease from $27.3 million in 2018

- Produced the single most substantial penalty in 2019 ($15M)

- Fourth-year in a row on top of the Top Enforcement Issues list

- The single most substantial penalty involved two affiliated firms allegedly failing to develop and implement a written AML program to monitor penny stocks for suspicious activities and to review wire transfers done in foreign currencies or involving high-risk jurisdictions or entities.

#2: Exchange-traded Funds/Products

- 13 ETF/ETP cases reported in 2019

- 30% increase from 10 in 2018

- $3.5 million in fines

- 218% increase from $1.1 million in 2018

- First time on the Top Enforcement Issues list since 2012

- The firm allegedly failed to supervise the delivery of prospectuses for ETFs and ETPs due to the lack of a reasonable supervisory system. The firm is fined $2.9 million.

#3: Misleading or Inaccurate Information

- 28 misleading information cases reported in 2019

- 18% decrease from 34 in 2018

- $3.3 million in fines

- 83% increase from $1.8 million in 2018

- First time on the Top Enforcement Issues list

- A firm and its owner allegedly made misleading and unbalanced communications with the public regarding a biotechnology company that the owner founded. The fine amounted to $800,000.

#4: Municipal Securities

- 8 municipal securities cases reported in 2019

- 11% increase from 9 in 2018

- $2.7 million in fines

- 50% increase from $1.8 million in 2018

- First time on the Top Enforcement Issues list since 2013

- A firm constantly failed to address municipal short positions and identifying thousands of interest payments to customers as tax-exempt when they’re, in fact, taxable. The firm is fined $2 million.

#5: Suitability

- 45 suitability cases reported in 2019

- 51% decrease from 91 in 2018

- $2.7 million in fines – 77% decrease from $11.8 million in 2017

- $17.2 million in restitution ordered

- A firm allegedly failed to reasonably supervise early UIT rollovers, resulting in its customers incurring sales charges that they didn’t have to incur had they held the UITs until the maturity dates. The firm was fined $800,000 and was required to pay $3.8 million in restitution.

Regulatory Fines Were Reduced only to Possibly Rise Back Up

The amount for the regulatory fines in 2019 were reduced by 35% from the year 2018. However, it’s foreseen that more cases will be filed in the year 2020 as many employees started working from their homes. Among the top issues with multiple cases are Anti-Money Laundering issues as firms failed to develop and implement effective supervisory programs.

AML remains one of the top issues in the financial industry, especially since the single largest AML case in 2019 was larger than the previous year’s AML case, even though the numbers went down. FINRA will likely sanction more firms severely for future AML violations due to inadequate AML programs tailored to their business operations.

Market Access Cases were also among the key issues during the year 2019. The number of cases increased from three cases, amounting to approximately $340,000 in fines during 2018, to seven cases, amounting to around $850,000 in fines the next year.

FINRA has some concerns regarding firms failing to adequately supervise their representatives in considering various share classes when making 529 plan recommendations. FINRA noted that approximately 100 firms self-reported through FINRA’s self-reporting initiative that is focused on 529 plan share classes.

With the coronavirus pandemic, the number of cases will likely go up in 2020. A large number of them will likely include COVID-19 scams, cybersecurity issues, insider trading, misrepresentations, and product failures. The number of cases even increased during the first quarter of 2020 compared to that of 2019.

FINRA’s Exams and Investigations Done Virtually

Because employees of financial firms are now working from their homes, FINRA cannot conduct on-site exams and investigations and then resorted to conducting virtual investigations. FINRA and SEC audits will likely work with firms to comply with regulations.

There will be difficulties with the current setup for investigations even when both FINRA and SEC work closely with firms. Complying with FINRA retention requirements is essential to ensure that there will be no problems with regulatory compliance and that cases with failing to maintain electronic records are at a minimum.

2020 will be More Challenging

Both FINRA and the firms will have a challenging year, especially because people are working from home. Without robust archiving solutions, firms and traders will have a hard time complying with FINRA text archiving and call monitoring requirements. Even if both FINRA and SEC work closely with firms to ensure compliance, they will have a hard time doing so without the necessary tools.

Remote workers using WhatsApp must also remember WhatsApp FINRA and SEC retention requirements. Many scammers will likely use convenient messaging solutions to reach a large number of people to scam them with information regarding COVID-19.

The other issues that make 2020 more challenging for FINRA, besides COVID-19 scams, are cybersecurity issues due to employees using less secure messaging applications, insider trading activities, misrepresentations, omissions, and suitability, and product failures.

Learn more about the relevant FINRA and SEC retention regulations here.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, eDiscovery response requirements and reduces risks in the financial industry sector. TeleMessage captures and records mobile content, including SMS, MMS, voice calls, social media, WhatsApp, and WeChat conversations from corporate or BYOD mobile phones. The messages are securely retained within TeleMessage servers or forwarded to an archiving data storage vendor of the firm’s choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for various ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving methods, you can always find the right tools or blend for your needs:

TeleMessage offers cross-carrier and international mobile text and calls archiving for Corporate and BYOD phones. Contact Us to try our secure enterprise messaging and mobile archiving products today.