A new year has begun, and for most compliance professionals in the U.S. financial services industry,it means preparing for the regulatory challenges that will come to their organization this year.

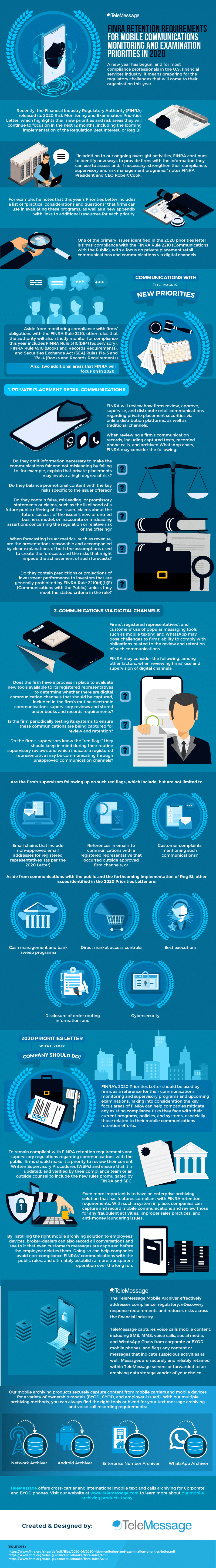

Recently, the Financial Industry Regulatory Authority (FINRA) released its 2020 Risk Monitoring and Examination Priorities Letter, which highlights their new priorities and risk areas they will continue to focus on in the next 12 months, including the looming implementation of the Regulation Best Interest, or Reg BI.

“In addition to our ongoing oversight activities, FINRA continues to identify new ways to provide firms with the information they can use to assess and, if necessary, strengthen their compliance, supervisory and risk management programs,” notes FINRA President and CEO Robert Cook. For example, he notes that this year’s Priorities Letter includes a list of “practical considerations and questions” that firms can use in evaluating these programs, as well as a new appendix with links to additional resources for each priority.

One of the primary issues identified in the 2020 priorities letter is firms’ compliance with the FINRA Rule 2210 (Communications with the Public), with a focus on private placement retail communications and communications via digital channels.

Communications with the Public – New Priorities

Aside from monitoring compliance with firms’ obligations with the FINRA Rule 2210, other rules that the authority will also strictly monitor for compliance this year includes FINRA Rule 3110(b)(4) (Supervisory), FINRA Rule 4510 (Books and Records Requirements), and Securities Exchange Act (SEA) Rules 17a-3 and 17a-4 (Books and Records Requirements)

Also, two additional areas that FINRA will focus on in 2020:

- Private Placement Retail Communications – FINRA will review how firms review, approve, supervise, and distribute retail communications regarding private placement securities via online distribution platforms, as well as traditional channels.

When reviewing a firm’s communication records, including captured texts, recorded phone calls, and archived WhatsApp chats, FINRA may consider the following:

- Do they omit information necessary to make the communications fair and not misleading by failing to, for example, explain that private placements may involve a high degree of risk?

- Do they balance promotional content with the key risks specific to the issuer offered?

- Do they contain false, misleading, or promissory statements or claims, such as the likelihood of a future public offering of the issuer, claims about the future success of the issuer’s new or untried business model, or inaccurate or misleading assertions concerning the regulation or relative risk of the offering?

- When forecasting issuer metrics, such as revenue, are the presentations reasonable and accompanied by clear explanations of both the assumptions used to create the forecasts and the risks that might impede the achievement of such forecasts?

- Do they contain predictions or projections of investment performance to investors that are generally prohibited by FINRA Rule 2210(d)(1)(F) (Communications with the Public), unless they meet the stated criteria in the rule?

- Communications via Digital Channels – Firms’, registered representatives’, and customers’ use of popular messaging tools such as mobile texting and WhatsApp may pose challenges to firms’ ability to comply with obligations related to the review and retention of such communications.

FINRA may consider the following, among other factors, when reviewing firms’ use and supervision of digital channels:

- Does the firm have a process in place to evaluate new tools available to its registered representatives to determine whether there are digital communication channels that should be captured, included in the firm’s routine electronic communications supervisory reviews and stored under books and records requirements?

- Is the firm periodically testing its systems to ensure these communications are being captured for review and retention?

- Do the firm’s supervisors know the “red flags” they should keep in mind during their routine supervisory reviews and which indicate a registered representative may be communicating through unapproved communication channels?

Are the firm’s supervisors following up on such red flags, which include, but are not limited to:

- Email chains that include non-approved email addresses for registered representatives(as per the 2020 Letter)

- References in emails to communications with a registered representative that occurred outside approved firm channels; or

- Customer complaints mentioning such communications?

Aside from communications with the public and the forthcoming implementation of Reg BI, other issues identified in the 2020 Priorities Letter are:

- Cash management and bank sweep programs;

- Direct market access controls;

- Best execution;

- Disclosure of order routing information; and

- Cybersecurity.

2020 Priorities Letter – What Your Company Should Do?

FINRA’s 2020 Priorities Letter should be used by firms as a reference for their communications monitoring and supervisory programs and upcoming examinations. Taking into consideration the key focus areas of FINRA can help companies mitigate any existing compliance risks they face with their current programs, policies, and systems, especially those related to their mobile communications retention efforts.

To remain compliant with FINRA retention requirements and supervisory regulations regarding communications with the public, firms should make it a priority to review their current Written Supervisory Procedures (WSPs) and ensure that it is updated and verified by their compliance team or an outside counsel, to include the new rules promulgated by FINRA and SEC.

Even more important is to have an enterprise archiving solution that has features compliant with FINRA retention requirements. With such a system in place, companies can capture and record mobile communications and review those for any fraudulent activities, improper sales practices, and anti-money laundering issues.

By installing the right mobile archiving solution to employees’ devices, broker-dealers can also record all conversations and see to it that even customer’s messages are captured before the employee deletes them. Doing so can help companies avoid non-compliance FINRAs’ communications with the public rules, and ultimately establish a more transparent operation over the long run.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, eDiscovery response requirements and reduces risks across the financial industry. TeleMessage captures voice calls mobile content, including SMS, MMS, voice calls, social media, and WhatsApp Chats from corporate or BYOD mobile phones, and flags any content or messages that indicate suspicious activities as well. Messages are securely and reliably retained within TeleMessage servers or forwarded to an archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving methods, you can always find the right tools or blend for your text message archiving and voice call recording requirements:

TeleMessage offers cross-carrier and international mobile text and calls archiving for Corporate and BYOD phones. Visit our website at www.telemessage.com to learn more about our mobile archiving products today.