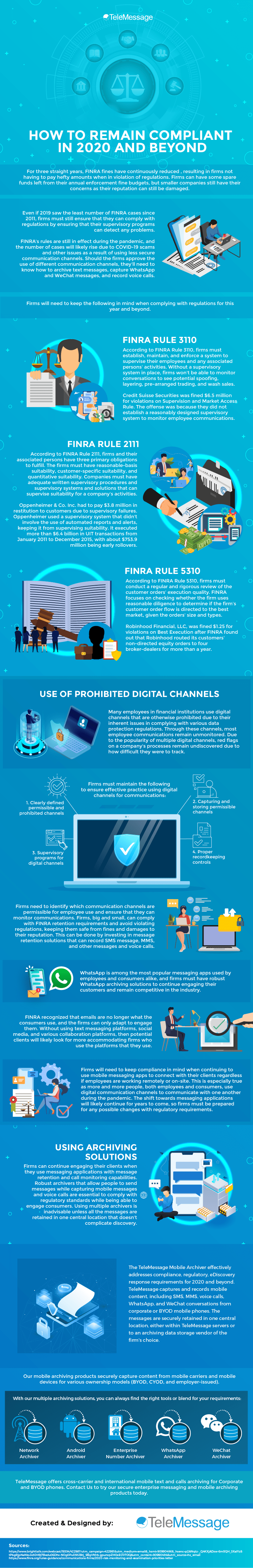

For three straight years, FINRA fines have continuously reduced, resulting in firms not having to pay hefty amounts when in violation of regulations. Firms can have some spare funds left from their annual enforcement fine budgets, but smaller companies still have their concerns as their reputation can still be damaged.

Even if 2019 saw the least number of FINRA cases since 2011, firms must still ensure that they can comply with regulations by ensuring that their supervisory programs can detect any problems. FINRA’s rules are still in effect during the pandemic, and the number of cases will likely rise due to COVID-19 scams and other issues as a result of using less secure communication channels. Should the firms approve the use of different communication channels, they’ll need to know how to archive text messages, capture WhatsApp and WeChat messages, and record voice calls.

Firms will need to keep the following in mind when complying with regulations for this year and beyond.

FINRA Rule 3110

According to FINRA Rule 3110, firms must establish, maintain, and enforce a system to supervise their employees and any associated persons’ activities. Without a supervisory system in place, firms won’t be able to monitor conversations to see potential spoofing, layering, pre-arranged trading, and wash sales.

Credit Suisse Securities was fined $6.5 million for violations on Supervision and Market Access Rule. The offense was because they did not establish a reasonably designed supervisory system to monitor employee communications.

FINRA Rule 2111

According to FINRA Rule 2111, firms and their associated persons have three primary obligations to fulfill. The firms must have reasonable-basis suitability, customer-specific suitability, and quantitative suitability. Companies must have adequate written supervisory procedures and supervisory systems and solutions that can supervise suitability for a company’s activities.

Oppenheimer & Co. Inc. had to pay $3.8 million in restitution to customers due to supervisory failures. Oppenheimer used a supervisory system that didn’t involve the use of automated reports and alerts, keeping it from supervising suitability. It executed more than $6.4 billion in UIT transactions from January 2011 to December 2015, with about $753.9 million being early rollovers.

FINRA Rule 5310

According to FINRA Rule 5310, firms must conduct a regular and rigorous review of the customer orders’ execution quality. FINRA focuses on checking whether the firm uses reasonable diligence to determine if the firm’s customer order flow is directed to the best market, given the orders’ size and types.

Robinhood Financial, LLC, was fined $1.25 for violations on Best Execution after FINRA found out that Robinhood routed its customers’ non-directed equity orders to four broker-dealers for more than a year.

Use of Prohibited Digital Channels

Many employees in financial institutions use digital channels that are otherwise prohibited due to their inherent issues in complying with various data protection regulations. Through these channels, most employee communications remain unmonitored. Due to the popularity of multiple digital channels, red flags on a company’s processes remain undiscovered due to how difficult they were to track.

Firms must maintain the following to ensure effective practice using digital channels for communications:

- Clearly defined permissible and prohibited channels

- Capturing and storing permissible channels

- Supervisory programs for digital channels

- Proper recordkeeping controls

Firms need to identify which communication channels are permissible for employee use and ensure that they can monitor communications. Firms, big and small, can comply with FINRA retention requirements and avoid violating regulations, keeping them safe from fines and damages to their reputation. This can be done by investing in message retention solutions that can record SMS message, MMS, and other messages and voice calls.

WhatsApp is among the most popular messaging apps used by employees and consumers alike, and firms must have robust WhatsApp archiving solutions to continue engaging their customers and remain competitive in the industry.

FINRA recognized that emails are no longer what the consumers use, and the firms can only adapt to engage them. Without using text messaging platforms, social media, and various collaboration platforms, then potential clients will likely look for more accommodating firms who use the platforms that they use.

Firms will need to keep compliance in mind when continuing to use mobile messaging apps to connect with their clients regardless if employees are working remotely or on-site. This is especially true as more and more people, both employees and consumers, use digital communication channels to communicate with one another during the pandemic. The shift towards messaging applications will likely continue for years to come, so firms must be prepared for any possible changes with regulatory requirements.

Using Archiving Solutions

Firms can continue engaging their clients when they use messaging applications with message retention and call monitoring capabilities. Robust archivers that allow people to send messages while capturing mobile messages and voice calls are essential to comply with regulatory standards while being able to engage consumers. Using multiple archivers is inadvisable unless all the messages are retained in one central location that doesn’t complicate discovery.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, eDiscovery response requirements for 2020 and beyond. TeleMessage captures and records mobile content, including SMS, MMS, voice calls, WhatsApp, and WeChat conversations from corporate or BYOD mobile phones. The messages are securely retained in one central location, either within TeleMessage servers or to an archiving data storage vendor of the firm’s choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for various ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving methods, you can always find the right tools or blend for your needs:

TeleMessage offers cross-carrier and international mobile text and calls archiving for Corporate and BYOD phones. Contact Us to try our secure enterprise messaging and mobile archiving products today.