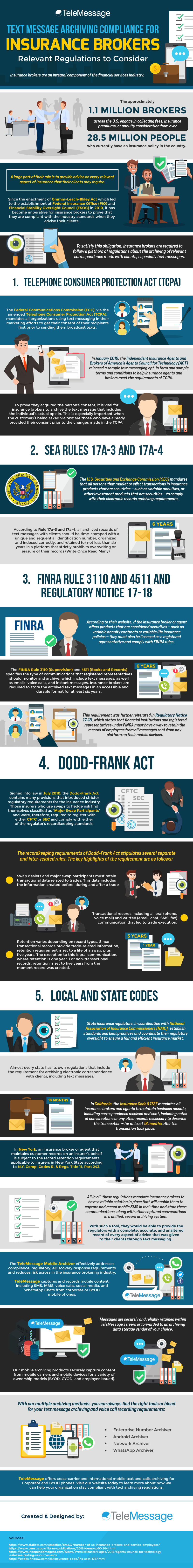

Insurance brokers are an integral component of the financial services industry. The approximately 1.1 million brokers across the U.S. engage in collecting fees, insurance premiums, or annuity consideration from over 28.5 million people who currently have an insurance policy in the country.

A large part of their role is to provide advice on every relevant aspect of insurance that their clients may require.

Since the enactment of Gramm-Leach-Bliley Act which led to the establishment of Federal Insurance Office (FIO) and Financial Stability Oversight Council (FSOC) in 2010, it has become imperative for insurance brokers to prove that they are compliant with the industry standards when they advise their clients.

To satisfy this obligation, insurance brokers are required to follow a plethora of regulations about the archiving of relevant correspondence made with clients, especially text messages.

1. Telephone Consumer Protection Act (TCPA)

1. Telephone Consumer Protection Act (TCPA)

The Federal Communications Commission (FCC), via the amended Telephone Consumer Protection Act (TCPA), mandates all organizations using text messaging in their marketing efforts to get their consent of their recipients first prior to sending them broadcast texts.

In January 2018, the Independent Insurance Agents and Brokers of America’s Agents Council for Technology (ACT) released a sample text messaging opt-in form and sample terms and conditions to help insurance agents and brokers meet the requirements of TCPA.

To prove they acquired the person’s consent, it is vital for insurance brokers to archive the text message that includes the individual’s actual opt-in. This is especially important when the customer/s being asked via text are those who have already provided their consent prior to the changes made in the TCPA.

2. SEA Rules 17a-3 and 17a-4

The U.S. Securities and Exchange Commission (SEC) mandates that all persons that market or effect transactions in insurance products that are securities – such as variable annuities, or other investment products that are securities – to comply with their electronic records archiving requirements.

According to Rule 17a-3 and 17a-4, all archived records of text messages with clients should be time-stamped with a unique and sequential identification number, organized and indexed correctly, and retained for not less than six years in a platform that strictly prohibits overwriting or erasure of their records (Write Once Read Many)

3. FINRA Rule 3110 and 4511 and Regulatory Notice 17-18

According to their website, if the insurance broker or agent offers products that are considered securities – such as variable annuity contracts or variable life insurance policies – they must also be licensed as a registered representative and comply with FINRA rules.

The FINRA Rule 3110 (Supervision) and 4511 (Books and Records) specifies the type of communications that registered representatives should monitor and archive, which include text messages, as well as emails, voice calls, and instant messages. Insurance brokers are required to store the archived text messages in an accessible and durable format for at least six years.

This requirement was further reiterated in Regulatory Notice 17-18, which states that financial institutions and registered representatives under FINRA must have a way to retain the records of employees from all messages sent from any platform on their mobile devices.

4. Dodd-Frank Act

Signed into law in July 2010, the Dodd-Frank Act contains many provisions that introduced stricter regulatory requirements for the insurance industry. Those insurers who use swaps to hedge risk find themselves classified as “Major Swap Participants” and were, therefore, required to register with the SEC and comply with either of the regulator’s recordkeeping standards.

The recordkeeping requirements of Dodd-Frank Act stipulates several separate and inter-related rules. The key highlights of the requirement are as follows:

- Swap dealers and major swap participants must retain transactional data related to trades. This data includes the information created before, during and after a trade

- Transactional records including all oral (phone, voice mail) and written (email, chat, SMS, fax) communication that led to trade execution.

- Retention varies depending on record types. Since transactional records provide trade-related information, retention requirement is set to a life of a swap, plus five years. The exception to this is oral communication, where retention is one year. For non-transactional records, retention is set to five yearsfrom the moment record was created.

5. Local and State Codes

State insurance regulators, in coordination with National Association of Insurance Commissioners (NAIC), establish standards and best practices and coordinate their regulatory oversight to ensure a fair and efficient insurance market.

Almost every state has its own regulations that include the requirement for archiving electronic correspondence with clients, including text messages.

In California, the Insurance Code § 1727 mandates all insurance brokers and agents to maintain business records, including correspondence received and sent, including notes of conversations or any other records necessary to describe the transaction – for at least 18 months after the transaction took place.

In New York, an insurance broker or agent that maintains customer records on an insurer’s behalf is subject to the record retention requirements applicable to insurers in New York State according to N.Y. Comp. Codes R. & Regs. Title 11, Part 243.

All in all, these regulations mandate insurance brokers to have a reliable solution in place that will enable them to capture and record mobile SMS in real-time and store these communications, along with other captured conversations in a unified, secure archiving system. With such a tool, they would be able to provide the regulators with a complete, accurate, and unaltered record of every aspect of advice that was given to their clients through text messaging.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, eDiscovery response requirements and reduces risk across in the insurance brokering industry. TeleMessage captures and records mobile content, including SMS, MMS, voice calls, social media, and WhatsApp Chats from corporate or BYOD mobile phones. Messages are securely and reliably retained within TeleMessage servers or forwarded to an archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving methods, you can always find the right tools or blend for your text message archiving and voice call recording requirements:

TeleMessage offers cross-carrier and international mobile text and calls archiving for Corporate and BYOD phones. Visit our website today to learn more about how we can help your organization stay compliant with text archiving regulations.