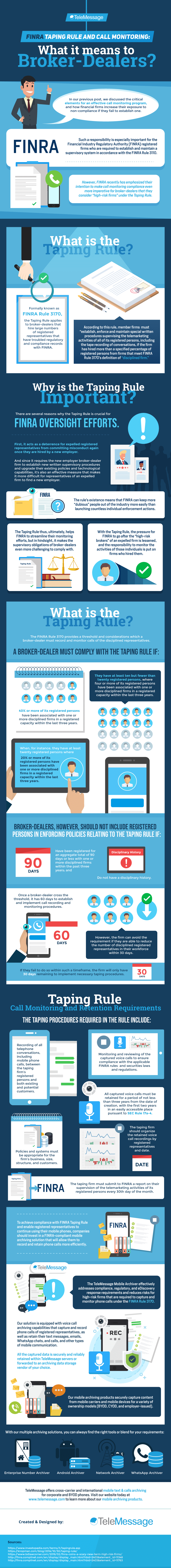

In our previous post, we discussed the critical elements for an effective call monitoring program, and how financial firms increase their exposure to non-compliance if they fail to establish one.

Such a responsibility is especially important for the Financial Industry Regulatory Authority (FINRA) registered firms who are required to establish and maintain a supervisory system in accordance with the FINRA Rule 3110. However, FINRA recently has emphasized their intention to make call monitoring compliance even more imperative for broker-dealers that they consider “high-risk firms” under the Taping Rule.

What is the Taping Rule? Why Call Monitoring?

Formally known as FINRA Rule 3170, the Taping Rule applies to broker-dealers that hire large numbers of registered representatives that have troubled regulatory and compliance records with FINRA.

According to this rule, member firms must “establish, enforce and maintain special written procedures supervising the telemarketing activities of all of its registered persons, including the tape recording of conversations, if the firm has hired more than a specified percentage of registered persons from firms that meet FINRA Rule 3170’s definition of “disciplined firm.”

Why is the Taping Rule Important?

There are several reasons why the Taping Rule is crucial for FINRA oversight efforts.

First, it acts as a deterrence for expelled registered representatives from committing misconduct again once they are hired by a new employer. And since it requires the new employer broker-dealer firm to establish new written supervisory procedures and upgrade their existing policies and technological capabilities, it’s also an effective measure that makes it more difficult for representatives of an expelled firm to find a new employer. The call monitoring rule’s existence means that FINRA can keep more “dubious” people out of the industry more easily than launching countless individual enforcement actions.

The Taping Rule thus, ultimately, helps FINRA to streamline their monitoring efforts, but in hindsight, it makes the supervisory obligations of broker-dealers even more challenging to comply with. With the Taping Rule, the pressure for FINRA to go after the “high-risk brokers” of an expelled firm is lessened, and the responsibility to monitor the activities of those individuals is put on firms who hired them.

Who Needs to Comply With The Call Monitoring and Taping Rule?

The FINRA Rule 3170 provides a threshold and considerations which a broker-dealer must record and monitor calls of the disciplined representatives.

A broker-dealer must comply with the Taping Rule if:

- 40% or more of its registered persons have been associated with one or more disciplined firms in a registered capacity within the last three years.

- They have at least ten but fewer than twenty registered persons, where four or more of its registered persons have been associated with one or more disciplined firms in a registered capacity within the last three years.

- When, for instance, they have at least twenty registered persons where 20% or more of its registered persons have been associated with one or more disciplined firms in a registered capacity within the last three years.

Broker-dealers, however, should not include registered persons in enforcing policies relating to the Taping Rule if:

- Have been registered for an aggregate total of 90 days or less with one or more disciplined firms within the past three years; and

- Do not have a disciplinary history.

Once a broker-dealer cross the threshold, it has 60 days to establish and implement call recording and monitoring procedures. However, the firm can avoid the requirement if they are able to reduce the number of disciplined registered representatives in their workforce within 30 days. If they fail to do so within such a timeframe, the firm will only have 30 days remaining to implement necessary taping procedures.

Taping Rule – Call Monitoring and Retention Requirements

The taping procedures required in the rule include:

- Recording of all telephone conversations, including mobile phone calls, between the taping firm’s registered persons and both existing and potential customers.

- Call Monitoring and reviewing of the captured voice calls to ensure compliance with the applicable FINRA rules and securities laws and regulations.

- Policies and systems must be appropriate for the firm’s business, size, structure, and customers.

- All captured voice calls must be retained for a period of not less than three years from the date of creation, with the first two years in an easily accessible place pursuant to SEC Rule 17a-4.

- The taping firm should organize the retained voice call recordings by registered representatives and date.

- The taping firm must submit to FINRA a report on their supervision of the telemarketing activities of its registered persons every 30th day of the month.

To achieve compliance with FINRA Taping Rule and enable registered representatives to continue using their mobile phones, companies should invest in a FINRA-compliant mobile archiving solution that will allow them to record and retain phone calls more efficiently.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, and eDiscovery response requirements and reduces risks for high-risk firms that are required to capture and monitor phone calls under the FINRA Rule 3170.

Our solution is equipped with voice call archiving capabilities that capture and record phone calls of registered representatives, as well as retain their text messages, emails, WhatsApp chats, and other types of mobile communication. All the captured data is securely and reliably retained within TeleMessage servers or forwarded to an archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving solutions, you can always find the right tools or blend for your call monitoring requirements:

TeleMessage offers cross-carrier and international mobile text & calls archiving for corporate and BYOD phones. Visit our website today at www.telemessage.com to learn more about our mobile archiving products.