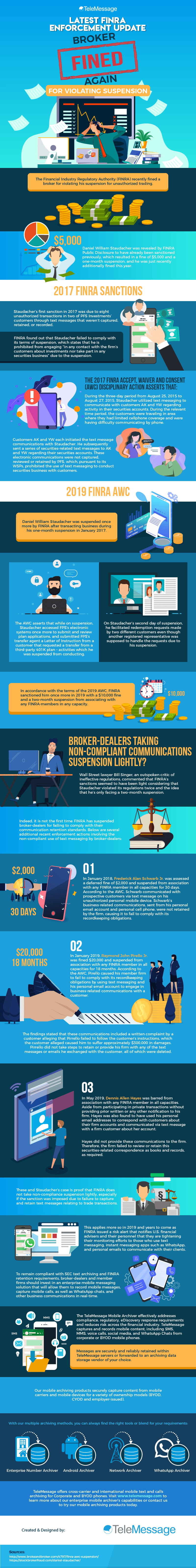

The Financial Industry Regulatory Authority (FINRA) recently fined a broker for violating his suspension for text messaging regulations. Daniel William Staudacher was revealed by FINRA Public Disclosure to have already been sanctioned previously, which resulted in a fine of $5,000 and a one-month suspension, and he was just recently additionally fined this year.

2017 FINRA Sanctions

Staudacher’s first sanction in 2017 was due to eight unauthorized transactions in two of PFS Investments’ customers through text messages that weren’t captured, retained, or recorded. FINRA found out that Staudacher failed to comply with its terms of suspension, which states that he is prohibited from engaging “in any contact with the firm’s customers about investments nor take part in any securities business” due to the suspension.

The 2017 FINRA Accept, Waiver and Consent (AWC) Disciplinary Action asserts that:

During the three-day period from August 25, 2015 to August 27, 2015, Staudacher utilized text messaging to communicate with customers AK and YW regarding activity in their securities accounts. During the relevant time period, the customers were traveling in area where they had limited cellphone coverage and were having difficulty communicating by phone. Customers AK and YW each initiated the text message communications with Staudacher. He subsequently sent a series of securities-related text messages to AK and YW regarding their securities accounts. These electronic communications were not captured, reviewed or retained by PFS, which, pursuant to its WSPs, prohibited the use of text messaging to conduct securities business with customers.

2019 FINRA AWC

Daniel William Staudacher was suspended once more by FINRA after messaging and transacting business during his one-month suspension in January 2017.

The AWC asserts that while on suspension, Staudacher accessed FPS’s electronic systems once more to submit and review plan applications, and submitted FPS’s transfer agent a Letter of Instruction from a customer that requested a transfer from a third-party 401K plan – activities which he was suspended from conducting.

On Staudacher’s second day of suspension, he facilitated redemption requests made by two different customers even though another registered representative was supposed to handle the requests due to his suspension.

In accordance with the terms of the 2019 AWC, FINRA sanctioned him once more in 2019 with a $10,000 fine and a two-month suspension from associating with any FINRA-members in any capacity.

Broker-Dealers Taking Non-Compliant Communications Suspension Lightly?

Wall Street lawyer Bill Singer, an outspoken critic of ineffective regulations, commented that FINRA’s sanctions seemed to have been light considering that Staudacher violated its regulations twice and the idea that he’s only facing a two-month suspension.

Indeed, it is not the first time FINRA has suspended broker-dealers for failing to comply with their messaging archiving standards. Below are several additional recent enforcement actions involving the non-compliant use of text messaging by broker-dealers:

- In January 2018, Frederick Alan Schwarb Jr.was assessed a deferred fine of $2,000 and suspended from association with any FINRA member in all capacities for 30 days. According to the AWC, Schwarb communicated with prospective customers via text message on his unauthorized personal mobile device.

Schwarb’s business-related communications, sent from his personal email account and personal cell phone, were not retained by the firm, causing it to fail to comply with its recordkeeping obligations.

- In January 2019, Raymond John Pirello Jr. was fined $20,000 and suspended from association with any FINRA member in all capacities for 18 months. According to the AWC, Pirello caused his member firm to fail to comply with its recordkeeping obligations by using text messaging and his personal email account to engage in business-related communications with a customer.

The findings stated that these communications included a written complaint by a customer alleging that Pirrello failed to follow the customer’s instructions, which the customer alleged caused him to suffer approximately $300,000 in damages. Pirrello did not take steps to retain or provide his firm with any of the text messages or emails he exchanged with the customer, all of which were deleted.

- In May 2019, DennisAllenHayes was barred from association with any FINRA member in all capacities. Aside from participating in private transactions without providing prior written or any other notification to his firm, Hayes was also found to have used his personal email addresses to correspond with customers about their firm accounts and communicated via text message with a firm customer about her account.

Hayes did not provide these communications to the firm. Therefore, the firm failed to review or retain this securities-related correspondence as books and records, as required.

These and Staudacher’s case are proof that FINRA does not take non-compliance suspension lightly, especially if the sanction was imposed due to failure to capture and retain text messages relating to trade transactions. This applies more so in 2019 and years to come as FINRA issued a risk alert that notifies U.S. financial advisers and their personnel that they are tightening their monitoring efforts to those who use text messaging, instant messaging apps such as WhatsApp, and personal emails to communicate with their clients.

To remain compliant with SEC text archiving and FINRA archiving requirements, broker-dealers and member firms should invest in an enterprise mobile messaging solution that will allow them to record mobile messages, capture mobile calls, as well as WhatsApp chats, and other business communications in real-time.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, eDiscovery response requirements and reduces risk across the financial industry. TeleMessage captures and records mobile content, including SMS, MMS, voice calls, social media, and WhatsApp Chats from corporate or BYOD mobile phones. Messages are securely and reliably retained within TeleMessage servers or forwarded to an archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD and employer-issued). With our multiple archiving methods, you can always find the right tools or blend for your text message archiving and voice call recording requirements:

TeleMessage offers cross-carrier and international mobile text and calls archiving for Corporate and BYOD phones. Visit www.telemessage.com to learn more about our enterprise mobile archiver’s capabilities or contact us to try our mobile archiving products today.