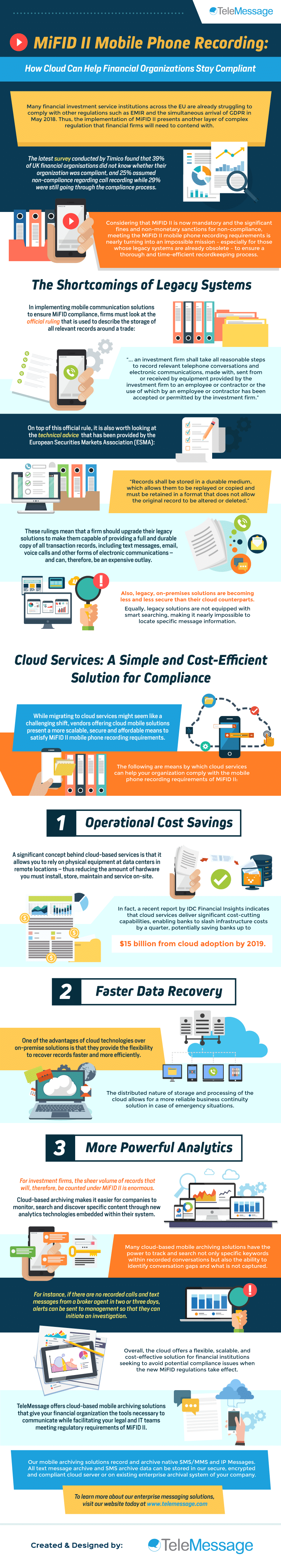

Many financial investment service institutions across the EU are already struggling to comply with other regulations such as EMIR and the simultaneous arrival of GDPR in May 2018. Thus, the implementation of MiFID II next year will only present another layer of complex regulation that financial firms will need to contend with.

The latest survey conducted by Timico found that 39% of UK financial organisations did not know whether their organization was compliant, and 25% assumed non-compliance regarding call recording while 29% were still going through the compliance process.

Considering the looming deadline and the significant fines and non-monetary sanctions for non-compliance, meeting the MiFID II mobile phone recording requirements is nearly turning into an impossible mission – especially for those whose legacy systems are already obsolete – to ensure a thorough and time-efficient recordkeeping process.

The Shortcomings of Legacy Systems

In implementing mobile communication solutions to ensure MiFID compliance, firms must look at the official ruling that is used to describe the storage of all relevant records around a trade:

“… an investment firm shall take all reasonable steps to record relevant telephone conversations and electronic communications, made with, sent from or received by equipment provided by the investment firm to an employee or contractor or the use of which by an employee or contractor has been accepted or permitted by the investment firm.”

On top of this official rule, it is also worth looking at the technical advice that has been provided by the European Securities Markets Association (ESMA):

“Records shall be stored in a durable medium, which allows them to be replayed or copied and must be retained in a format that does not allow the original record to be altered or deleted.”

These rulings mean that a firm should upgrade their legacy solutions to make them capable of providing a full and durable copy of all transaction records, including text messages, email, voice calls and other forms of electronic communications – and can, therefore, be an expensive outlay.

Also, legacy, on-premises solutions are becoming less and less secure than their cloud counterparts. Equally, legacy solutions are not equipped with smart searching, making it nearly impossible to locate specific message information.

Cloud Services: A Simple and Cost-Efficient Solution for Compliance

While migrating to cloud services might seem like a challenging shift, vendors offering cloud mobile solutions present a more scalable, secure and affordable means to satisfy MiFID II mobile phone recording requirements.

The following are means by which cloud services can help your organization comply with the mobile phone recording requirements of MiFID II:

1. Operational Cost Savings

A significant concept behind cloud-based services is that it allows you to rely on physical equipment at data centers in remote locations – thus reducing the amount of hardware you must install, store, maintain and service on site.

In fact, a recent report by IDC Financial Insights indicates that cloud services deliver significant cost-cutting capabilities, enabling banks to slash infrastructure costs by a quarter, potentially saving banks up to $15 billion from cloud adoption by 2019.

2. Faster Data Recovery

One of the advantages of cloud technologies over on-premise solutions is that they provide the flexibility to recover records faster and more efficiently. The distributed nature of storage and processing of the cloud allows for more a reliable business continuity solution in case of emergency situations.

3. More Powerful Analytics

For investment firms, the sheer volume of records that will, therefore, be counted under MiFID II is enormous. Cloud-based archiving makes it easier for companies to monitor, search, discover specific content through new analytics technologies embedded within their system.

Many MiFID mobile phone recording cloud-based mobile archiving solutions have the power to track and search not only specific keywords within recorded conversations but also the ability to identify conversation gaps and what is not captured.

For instance, if there are no recorded calls and text messages from a broker agent in two or three days, alerts can be sent to management so that they can initiate an investigation. This feature enables companies to perform due diligence that helps them stay compliant with the recordkeeping requirements of MiFID II.

Overall, the cloud offers a flexible, scalable, and cost-effective MiFID mobile phone recording solution for financial institutions seeking to avoid potential compliance issues when the new MiFID regulations take effect.

TeleMessage offers cloud-based mobile archiving solutions that give your financial organization the tools necessary to communicate while facilitating your legal and IT teams meeting regulatory requirements of MiFID II.

Our mobile archiving solutions record and archive native SMS/MMS and IP Messages. All text message archive and SMS archive data can be stored in our secure, encrypted and compliant cloud server or on existing enterprise archival system of your company.

To learn more about our enterprise messaging solutions, visit our website today at www.telemessage.com

To learn more about our enterprise messaging solutions, visit our website today at www.telemessage.com