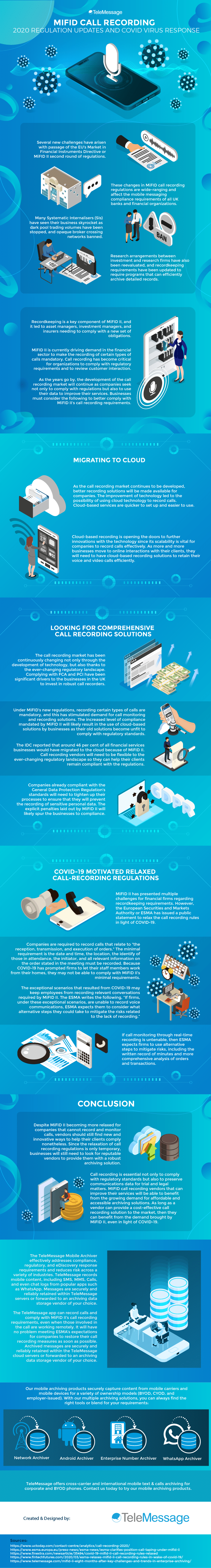

Several new challenges have arisen with passage of the EU’s Market in Financial Instruments Directive or MiFID II second round of regulations. These changes in MiFID call recording regulations are wide-ranging and affect the mobile messaging compliance requirements of all UK banks and financial organizations.

Many Systematic Internalisers (SIs) have seen their business skyrocket as dark pool trading volumes have been stopped, and opaque broker crossing networks banned. Research arrangements between investment and research firms have also been reevaluated, and recordkeeping requirements have been updated to require programs that can efficiently archive detailed records.

Recordkeeping is a key component of MiFID II, and it led to asset managers, investment managers, and insurers needing to comply with a new set of obligations. MiFID II is currently driving demand in the financial sector to make the recording of certain types of calls mandatory. Call recording has become critical for organizations to comply with regulatory requirements and to review customer interaction.

As the years go by, the development of the call recording market will continue as companies seek not only to comply with regulations but also to use their data to improve their services. Businesses must consider the following to better comply with MiFID II’s call recording requirements.

Migrating to Cloud

As the call recording market continues to be developed, better recording solutions will be made available for companies. The improvement of technology led to the possibility of using cloud technology to record calls. Cloud-based services are quicker to set up and easier to use.

Cloud-based recording is opening the doors to further innovations with the technology since its scalability is vital for companies to record calls effectively. As more and more businesses move to online interactions with their clients, they will need to have cloud-based recording solutions to retain their voice and video calls efficiently.

Looking for Comprehensive Call Recording Solutions

The call recording market has been continuously changing not only through the development of technology, but also thanks to the ever-changing regulatory landscape. Complying with FCA and PCI have been significant drivers to the businesses in the UK to invest in robust call recorders.

Under MiFID’s new regulations, recording certain types of calls are mandatory, and this has stimulated demand for call monitoring and recording solutions. The increased level of compliance mandated by MiFID II will likely result in the use of cloud-based solutions by businesses as their old solutions become unfit to comply with regulatory standards.

The IDC reported that around 46 per cent of all financial services businesses would have migrated to the cloud because of MiFID II. Call recording vendors will need to be flexible to the ever-changing regulatory landscape so they can help their clients remain compliant with the regulations.

Companies already compliant with the General Data Protection Regulation’s standards will need to tighten up their processes to ensure that they will prevent the recording of sensitive personal data. The explicit penalties laid out by MiFID II will likely spur the businesses to compliance.

COVID-19 Motivated Relaxed Call-Recording Regulations

MiFID II has presented multiple challenges for financial firms regarding recordkeeping requirements. However, the European Securities and Markets Authority or ESMA has issued a public statement to relax the call recording rules in light of COVID-19.

Companies are required to record calls that relate to “the reception, transmission, and execution of orders.” The minimal requirement is the date and time, the location, the identify of those in attendance, the initiator, and all relevant information on the order stated in the meeting must be recorded. Because COVID-19 has prompted firms to let their staff members work from their homes, they may not be able to comply with MiFID II’s minimal requirements.

The exceptional scenarios that resulted from COVID-19 may keep employees from recording relevant conversations required by MiFID II. The ESMA writes the following, “If firms, under these exceptional scenarios, are unable to record voice communications, ESMA expects them to consider what alternative steps they could take to mitigate the risks related to the lack of recording.”

If call monitoring through real-time recording is untenable, then ESMA expects firms to use alternative steps to mitigate risks, including the written record of minutes and more comprehensive analysis of orders and transactions.

Conclusion

Despite MiFID II becoming more relaxed for companies that cannot record and monitor calls, vendors should still find new and innovative ways to help their clients comply nonetheless. Since the relaxation of call recording regulations is only temporary, businesses will still need to look for reputable vendors to provide them with a robust archiving solution.

Call recording is essential not only to comply with regulatory standards but also to preserve communications data for trial and legal matters. MIFID call recording vendors that can improve their services will be able to benefit from the growing demand for affordable and accessible archiving solutions. As long as a vendor can provide a cost-effective call recording solution to the market, then they can benefit from the demand brought by MiFID II, even in light of COVID-19.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, and eDiscovery response requirements and reduces risk across a variety of industries. TeleMessage records mobile content, including SMS, MMS, Calls, and even chat logs from popular apps such as WhatsApp. Messages are securely and reliably retained within TeleMessage servers or forwarded to an archiving data storage vendor of your choice.

The TeleMessage app can record calls and comply with MiFID II’s call recording requirements, even when those involved in the call are working remotely. It will have no problem meeting ESMA’s expectations for companies to restore their call recording measures as soon as possible. Archived messages are securely and reliably retained within the TeleMessage cloud servers or forwarded to an archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving solutions, you can always find the right tools or blend for your requirements:

TeleMessage offers cross-carrier and international mobile text & calls archiving for corporate and BYOD phones. Contact us today to try our mobile archiving products.