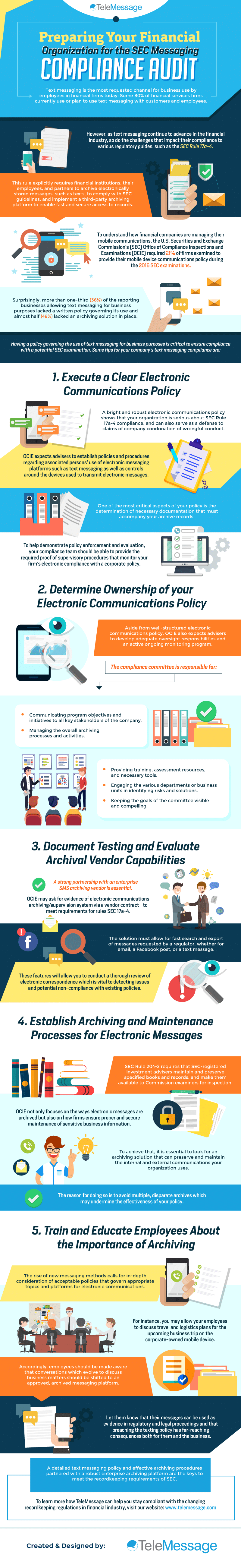

Text messaging is the most requested channel for business use by employees in financial firms today: Some 80% of financial services firms currently use or plan to use text messaging with customers and employees.

However, as text messaging continue to advance in the financial industry, so does the challenges that impact their text messaging compliance to various regulatory guides, such as the SEC Rule 17a-4. This rule explicitly requires financial institutions, their employees, and partners to archive electronically stored messages, such as texts, to comply with SEC guidelines, and implement a third-party archiving platform to enable fast and secure access to records.

To understand how financial companies are managing their mobile communications, the U.S. Securities and Exchange Commission’s (SEC) Office of Compliance Inspections and Examinations (OCIE) required 21% of firms examined to provide their mobile device communications policy during the 2016 SEC examinations. Surprisingly, more than one-third (36%) of the reporting businesses allowing text messaging for business purposes lacked a written policy governing its use and almost half (48%) lacked an sec text message archiving solution in place.

Having a policy governing the use of text messaging for business purposes is critical to ensure compliance with a potential SEC examination. Some tips for your company’s text messaging compliance are:

1. Execute a Clear Electronic Communications Policy

A bright and robust electronic communications policy shows that your organization is serious about SEC Rule 17a-4 compliance, and can also serve as a defense to claims of company condonation of wrongful conduct.

OCIE expects advisers to establish policies and procedures regarding associated persons’ use of electronic messaging platforms such as text messaging as well as controls around the devices used to transmit electronic messages.

One of the most critical aspects of your policy is the determination of necessary documentation that must accompany your archive records. To help demonstrate policy enforcement and evaluation, your text messaging compliance team should be able to provide the required proof of supervisory procedures that monitor your firm’s electronic text messaging compliance compliance with a corporate policy.

2. Determine Ownership of your Electronic Communications Policy

Aside from well-structured electronic communications policy, OCIE also expects advisers to develop adequate oversight responsibilities and an active ongoing monitoring program. The text messaging compliance committee is responsible for:

- Communicating program objectives and initiatives to all key stakeholders of the company.

- Managing the overall archiving processes and activities.

- Providing training, assessment resources, and necessary tools.

- Engaging the various departments or business units in identifying risks and solutions.

- Keeping the goals of the committee visible and compelling.

3. Document Testing and Evaluate Archival Vendor Capabilities

A strong partnership with an enterprise SMS archiving vendor is essential. OCIE may ask for evidence of electronic communications archiving/supervision system via a vendor contract—to meet requirements for rules SEC 17a-4.

The solution must allow for fast search and export of messages requested by a regulator, whether for email, a Facebook post, or a text message. These features will allow you to conduct a thorough review of electronic correspondence which is vital to detecting issues and potential non-compliance with existing policies.

4. Establish Archiving and Maintenance Processes for Electronic Messages

SEC Rule 204-2 requires that SEC-registered investment advisers maintain and preserve specified books and records, and make them available to Commission examiners for inspection. OCIE not only focuses on the ways electronic messages are archived but also on how firms ensure proper and secure maintenance of sensitive business information.

To achieve that, it is essential to look for an archiving solution that can preserve and maintain the internal and external communications your organization uses. The reason for doing so is to avoid multiple, disparate archives which may undermine the effectiveness of your policy and violate text messaging compliance.

5. Train and Educate Employees About the Importance of Archiving

The rise of new messaging methods calls for in-depth consideration of acceptable policies that govern appropriate topics and platforms for electronic communications. For instance, you may allow your employees to discuss travel and logistics plans for the upcoming business trip on the corporate-owned mobile device.

Accordingly, employees should be made aware that conversations which evolve to discuss business matters should be shifted to an approved, archived messaging platform. Let them know that their messages can be used as evidence in regulatory and legal proceedings and that breaching the texting policy has far-reaching consequences both for them and the business.

A detailed text messaging policy and effective sec text message archiving procedures partnered with a robust enterprise archiving platform are the keys to meet the recordkeeping requirements of SEC. To learn more how TeleMessage can help you stay compliant with the changing recordkeeping regulations in financial industry, visit our website: www.telemessage.com

A detailed text messaging policy and effective sec text message archiving procedures partnered with a robust enterprise archiving platform are the keys to meet the recordkeeping requirements of SEC. To learn more how TeleMessage can help you stay compliant with the changing recordkeeping regulations in financial industry, visit our website: www.telemessage.com