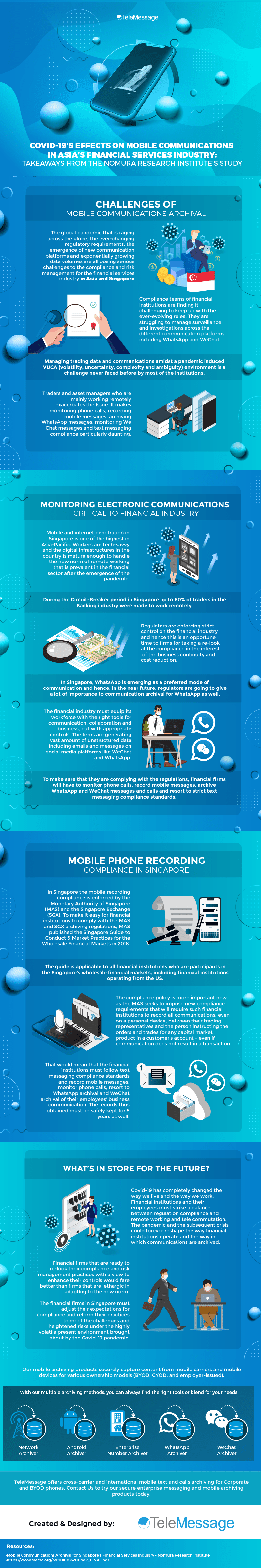

Challenges of mobile communications archival

This blog illustrates the effects of Covid on mobile communication in Asia’s financial services industry based on the takeaways from the Nomura Research Institute study

The global pandemic that is raging across the globe, the ever-changing regulatory requirements, the emergence of new communication platforms and exponentially growing data volumes are all posing serious challenges to the compliance and risk management for the financial services industry in Asia and Singapore.

Compliance teams of financial institutions are finding it challenging to keep up with the ever-evolving rules. They are struggling to manage surveillance and investigations across the different communication platforms including WhatsApp and WeChat. Managing trading data and communications amidst a pandemic induced VUCA (volatility, uncertainty, complexity and ambiguity) environment is a challenge never faced before by most of the institutions.

Traders and asset managers who are mainly working remotely exacerbates the issue. It makes monitoring phone calls, recording mobile messages, archiving WhatsApp messages, monitoring We Chat messages and text messaging compliance particularly daunting.

Monitoring electronic communications critical to the financial industry

Mobile and internet penetration in Singapore is one of the highest in Asia-Pacific. Workers are tech-savvy and the digital infrastructures in the country is mature enough to handle the new norm of remote working that is prevalent in the financial sector after the emergence of the pandemic. During the Circuit-Breaker period in Singapore, up to 80% of traders in the Banking industry were made to work remotely.

Regulators are enforcing strict control on the financial industry and hence this is an opportune time for firms for taking a re-look at compliance in the interest of business continuity and cost reduction. In Singapore, WhatsApp is emerging as a preferred mode of communication and hence, shortly, regulators are going to give a lot of importance to communication archival for WhatsApp as well.

The financial industry must equip its workforce with the right tools for communication, collaboration and business, but with appropriate controls. The firms are generating a vast amount of unstructured data including emails and messages on social media platforms like WeChat and WhatsApp. To make sure that they are complying with the regulations, financial firms will have to monitor phone calls, record mobile messages, archive WhatsApp and WeChat messages and calls and resort to strict text messaging compliance standards.

Mobile phone recording compliance in Singapore

In Singapore, mobile recording compliance is enforced by the Monetary Authority of Singapore (MAS) and the Singapore Exchange (SGX). To make it easy for financial institutions to comply with the MAS and SGX archiving regulations, MAS published the Singapore Guide to Conduct & Market Practices for the Wholesale Financial Markets in 2018.

The guide applies to all financial institutions who are participants in Singapore’s wholesale financial markets, including financial institutions operating from the US. The compliance policy is more important now as the MAS seeks to impose new compliance requirements that will require such financial institutions to record all communications, even on a personal device, between their trading representatives and the person instructing the orders and trades for any capital market product in a customer’s account – even if communication does not result in a transaction.

That would mean that the financial institutions must follow text messaging compliance standards and record mobile messages, monitor phone calls, resort to WhatsApp archival and WeChat archival of their employees’ business communication. The records thus obtained must be safely kept for 5 years as well.

What’s in store for the future?

Covid-19 has completely changed the way we live and the way we work. Financial institutions and their employees must strike a balance between regulatory compliance and remote working and telecommunication needs. The pandemic and the subsequent crisis could forever reshape the way financial institutions operate and the way in which communications are archived.

Financial firms that are ready to re-look their compliance and risk management practices with a view to enhancing their controls would fare better than firms that are lethargic in adapting to the new norm. The financial firms in Singapore must adjust their expectations for compliance and reform their practices to meet the challenges and heightened risks under the highly volatile present environment brought about by the Covid-19 pandemic.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, eDiscovery response requirements and reduces risks across the financial industry. TeleMessage solutions can capture voice calls, capture mobile text, and other mobile communications on corporate or BYOD mobile phones, and flag any content or messages that indicate suspicious activities as well. Messages are securely and reliably retained within TeleMessage servers or forwarded to an archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving methods, you can always find the right tools or blend for your text message archiving and voice call recording requirements:

TeleMessage offers cross-carrier and international mobile text and calls archiving for Corporate and BYOD phones. Visit our website at www.telemessage.com to learn more about our mobile archiving products today.