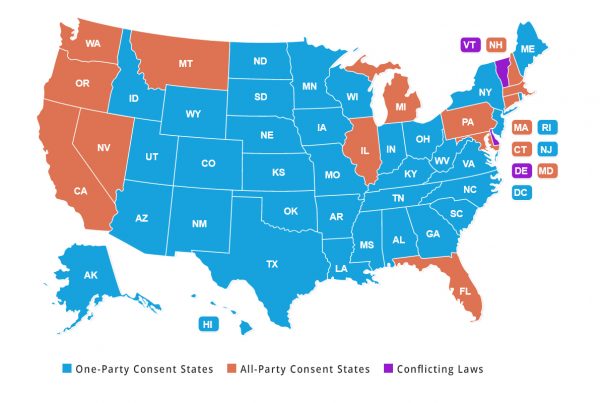

In the midst of evolving and complex call recording regulations, many organizations around the world – particularly in the banking and financial services sector – have been tightening their policies to ensure the activities of their employees are compliant with these regulatory requirements.

However, even though complying with call recording regulations can be extremely cumbersome, non-compliance can cost financial organizations hundreds of thousands or even millions of dollars. To avoid costly and embarrassing penalties, more and more companies are investing in new technologies, such as voice call recording and archiving systems, for compliance.

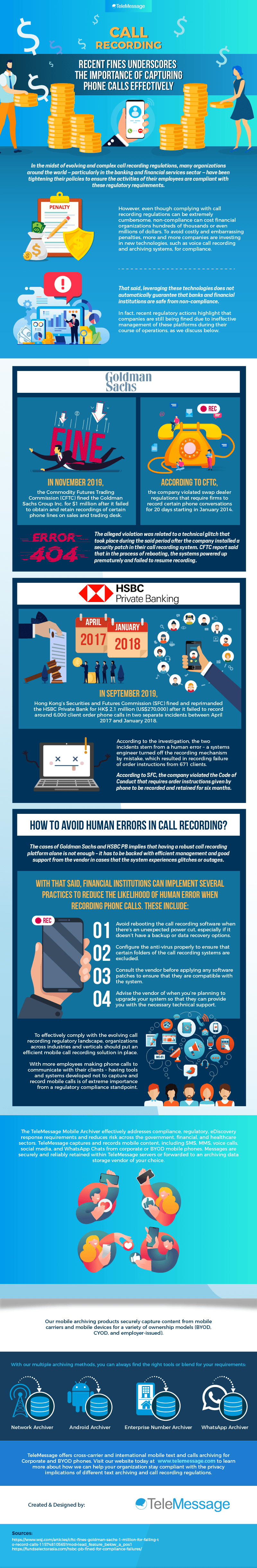

That said, leveraging these technologies does not automatically guarantee that banks and financial institutions are safe from non-compliance. In fact, recent regulatory actions highlight that companies are still being fined due to ineffective management of these platforms during their course of operations, as we discuss below.

Goldman Sachs

In November 2019, the Commodity Futures Trading Commission (CFTC) fined the Goldman Sachs Group Inc. for $1 million after it failed to obtain and retain recordings of certain phone lines on sales and trading desk.

According to CFTC, the company violated swap dealer regulations that require firms to record certain phone conversations for 20 days starting in January 2014.

The alleged violation was related to a technical glitch that took place during the said period after the company installed a security patch in their call recording system. CFTC report said that in the process of rebooting, the systems powered up prematurely and failed to resume recording.

HSBC PB

In September 2019, Hong Kong’s Securities and Futures Commission (SFC) fined and reprimanded the HSBC Private Bank for HK$ 2.1 million (US$270,000) after it failed to record around 6,000 client order phone calls in two separate incidents between April 2017 and January 2018.

According to the investigation, the two incidents stem from a human error – a systems engineer turned off the recording mechanism by mistake, which resulted in recording failure of order instructions from 671 clients.

According to SFC, the company violated the Code of Conduct that requires order instructions given by phone to be recorded and retained for six months.

How to Avoid Human Errors in Call Recording?

The cases of Goldman Sachs and HSBC PB implies that having a robust call recording platform alone is not enough – it has to be backed with efficient management and good support from the vendor in cases that the system experiences glitches or outages.

With that said, financial institutions can implement several practices to reduce the likelihood of human error when recording phone calls. These include:

- Avoid rebooting the call recording software when there’s an unexpected power cut, especially if it doesn’t have a backup or data recovery options.

- Configure the anti-virus properly to ensure that certain folders of the call recording systems are excluded.

- Consult the vendor before applying any software patches to ensure that they are compatible with the system.

- Advise the vendor of when you’re planning to upgrade your system so that they can provide you with the necessary technical support.

To effectively comply with the evolving call recording regulatory landscape, organizations across industries and verticals should put an efficient mobile call recording solution in place. With more employees making phone calls to communicate with their clients – having tools and systems developed not to capture and record mobile calls is of extreme importance from a regulatory compliance standpoint.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, eDiscovery response requirements and reduces risk across the government, financial, and healthcare sectors. TeleMessage captures and records mobile content, including SMS, MMS, voice calls, social media, and WhatsApp Chats from corporate or BYOD mobile phones. Messages are securely and reliably retained within TeleMessage servers or forwarded to an archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving methods, you can always find the right tools or blend for your text message archiving and voice call recording requirements:

TeleMessage offers cross-carrier and international mobile text and calls archiving for Corporate and BYOD phones. Visit our website today at www.telemessage.com to learn more about how we can help your organization stay compliant with the privacy implications of different text archiving and call recording regulations.