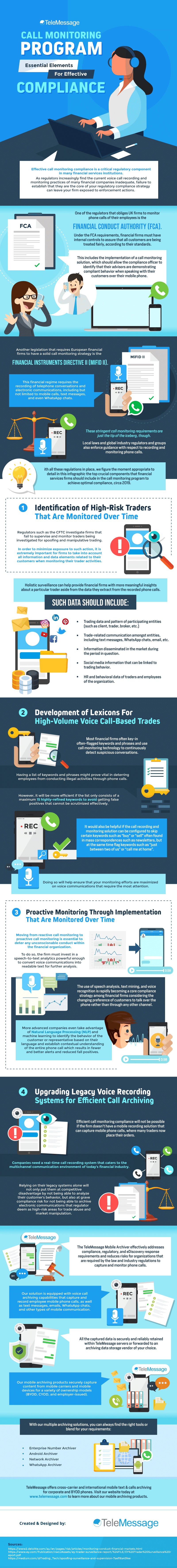

Effective call monitoring compliance is a critical regulatory component in many financial services institutions. As regulators increasingly find the current voice call recording and monitoring practices of many financial companies inadequate, failure to establish that they are the core of your regulatory compliance strategy can leave your firm exposed to enforcement actions.

One of the regulators that obliges UK firms to monitor phone calls of their employees is the Financial Conduct Authority (FCA).

Under the FCA requirements, financial firms must have internal controls to assure that all customers are being treated fairly, according to their standards. This includes the implementation of a call monitoring solution, which should allow the compliance officer to identify that their advisors are demonstrating compliant behavior when speaking with their customers over their mobile phone.

Another legislation that requires European financial firms to have a solid call monitoring strategy is the Markets in Financial Instruments Directive II (MiFID II). This financial regime requires the recording of telephone conversations and electronic communications, including but not limited to mobile calls, text messages, and even WhatsApp chats.

These stringent call monitoring requirements are just the tip of the iceberg, though. Local laws and global industry regulators and groups also enforce guidance with respect to recording and monitoring phone calls. With all these regulations in place, we figure the moment appropriate to detail in this infographic the top crucial components that financial services firms should include in the call monitoring program to achieve optimal compliance, circa 2019.

- Identification of High-Risk Traders That Are Monitored Over Time

Regulators such as the CFTC investigate firms that fail to supervise and monitor traders being investigated for spoofing and manipulative trading. In order to minimize exposure to such action, it is extremely important for firms to take into account all information and data elements related to their customers when monitoring their trader activities.

Holistic surveillance can help provide financial firms with more meaningful insights about a particular trader aside from the data they extract from the recorded phone calls. Such data should include:

- Trading data and pattern of participating entities (such as client, trader, broker, etc.)

- Trade-related communication amongst entities, including text messages, WhatsApp chats, email, etc.

- Information disseminated in the market during the period in question.

- Social media information that can be linked to trading behavior.

- HR and behavioral data of traders and employees of the organization.

- Development of Lexicons For High-Volume Voice Call-Based Trades

Most financial firms often key-in often-flagged keywords and phrases and use call monitoring technology to continuously detect suspicious conversations.

Having a list of keywords and phrases might prove vital in deterring employees from conducting illegal activities through phone calls. However, it will be more efficient if the list only consists of a maximum 15 highly-refined keywords to avoid getting false positives that cannot be scrutinized effectively.

It would also be helpful if the call recording and monitoring solution can be configured to skip certain keywords such as “buy” or “sell” often found in mass correspondences such as newsletters, but at the same time flag keywords such as “just between two of us” or “call me at home”. Doing so will help ensure that your monitoring efforts are maximized on voice communications that require the most attention.

- Proactive Monitoring Through Implementation of Real-Time Speech Analytics

Moving from reactive call monitoring to proactive call monitoring is essential to deter any unconscionable conduct within the financial organization. To do so, the firm must invest in a speech-to-text analytics powerful enough to convert voice communications into readable text for further analysis.

The use of speech analysis, text mining, and voice recognition is rapidly becoming a core compliance strategy among financial firms considering the changing preference of customers to talk over the phone rather than through any other channel.

More advanced companies even take advantage of Natural Language Processing (NLP) and machine learning to identify the behavior of the customer or representative based on their language and establish contextual understanding of the entire phone call which results in fewer and better alerts and reduced fall positives.

- Upgrading Legacy Voice Recording Systems for Efficient Call Archiving

Efficient call monitoring compliance will not be possible if the firm doesn’t have a mobile recording solution that can capture mobile phone calls, where many traders now place their orders.

Companies need a real-time call recording system that caters to the multichannel communication environment of today’s financial industry. Relying on their legacy systems alone will not only put them at competitive disadvantage by not being able to analyze their customer’s behavior, but also at grave compliance risk for not being able to archive electronic communications that regulator deem as high-risk areas for trade abuse and market manipulation.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, and eDiscovery response requirements and reduces risks for organizations that are required by the law and industry regulations to capture and monitor phone calls.

Our solution is equipped with voice call archiving capabilities that capture and record employee mobile phone calls, as well as text messages, emails, WhatsApp chats, and other types of mobile communication. All the captured data is securely and reliably retained within TeleMessage servers or forwarded to an archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving solutions, you can always find the right tools or blend for your requirements:

TeleMessage offers cross-carrier and international mobile text & calls archiving for corporate and BYOD phones. Visit our website today at www.telemessage.com to learn more about our mobile archiving products.