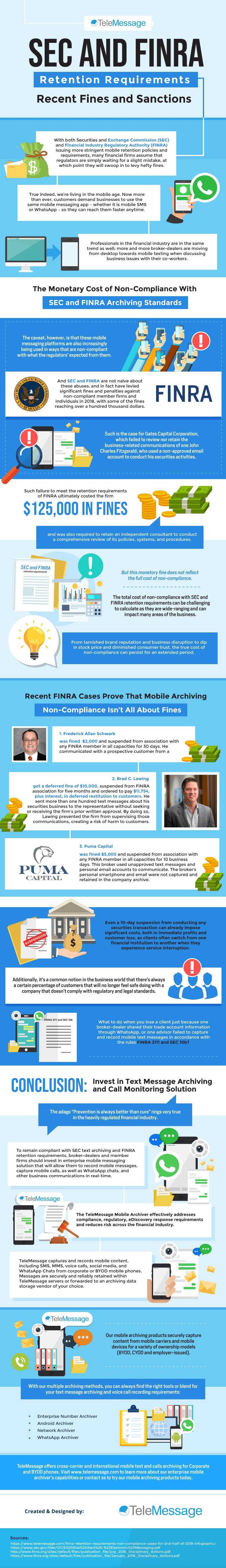

With both Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) issuing more stringent mobile retention policies and requirements, many financial firms assume that regulators are simply waiting for a slight mistake, at which point they will swoop in to levy hefty fines.

True indeed, we’re living in the mobile age. Now more than ever, customers demand businesses to use the same mobile messaging app – whether it is mobile SMS or WhatsApp – so they can reach them faster anytime. Professionals in the financial industry are in the same trend as well; more and more broker-dealers are moving from desktop towards mobile texting when discussing business issues with their co-workers.

The Monetary Cost of Non-Compliance With SEC and FINRA Archiving Standards

The caveat, however, is that these mobile messaging platforms are also increasingly being used in ways that are non-compliant with what the regulators’ expected from them.

And SEC and FINRA are not naïve about these abuses, and in fact have levied significant fines and penalties against non-compliant member firms and individuals in 2018, with some of the fines reaching over a hundred thousand dollars.

Such is the case for Gates Capital Corporation, which failed to review nor retain the business-related communications of one John Charles Fitzgerald, who used a non-approved email account to conduct his securities activities. Such failure to meet the retention requirements of FINRA ultimately costed the firm $125,000 in fines and was also required to retain an independent consultant to conduct a comprehensive review of its policies, systems, and procedures.

But this monetary fine does not reflect the full cost of non-compliance. The total cost of non-compliance with SEC and FINRA retention requirements can be challenging to calculate as they are wide-ranging and can impact many areas of the business. From tarnished brand reputation and business disruption to dip in stock price and diminished consumer trust, the true cost of non-compliance can persist for an extended period.

Recent FINRA Cases Prove That Mobile Archiving Non-Compliance Isn’t All About Fines

Recent FINRA Cases Prove That Mobile Archiving Non-Compliance Isn’t All About Fines

- Frederick Allan Schwarb was fined $2,000 and suspended from association with any FINRA member in all capacities for 30 days. He communicated with a prospective customer from a personal phone without firm’s authorization and messages were not archived.

- Brad C. Lawing got a deferred fine of $10,000, suspended from FINRA association for five months and ordered to pay $11,754, plus interest, in deferred restitution to customers. He sent more than one hundred text messages about his securities business to the representative without seeking or receiving the firm’s prior written approval. By doing so, Lawing prevented the firm from supervising those communications, creating a risk of harm to customers.

- Puma Capital was fined $5,000 and suspended from association with any FINRA member in all capacities for 10 business days. This broker used unapproved text messages and personal email accounts to communicate. The broker’s personal smartphone and email were not captured and retained in the company archive.

Even a 10-day suspension from conducting any securities transaction can already impose significant costs, both in immediate profits and customer loss, as clients often switch from one financial institution to another when they experience service interruption. Additionally, it’s a common notion in the business world that there’s always a certain percentage of customers that will no longer feel safe doing with a company that doesn’t comply with regulatory and legal standards.

What to do when you lose a client just because one broker-dealer shared their trade account information through WhatsApp, or one advisor failed to capture and record mobile text messages in accordance with the rules FINRA 2111 and SEC 10b?

Conclusion: Invest in Text Message Archiving and Call Monitoring Solution

The adage “Prevention is always better than cure” rings very true in the heavily regulated financial industry.

To remain compliant with SEC text archiving and FINRA retention requirements, broker-dealers and member firms should invest in enterprise mobile messaging solution that will allow them to record mobile messages, capture mobile calls, as well as WhatsApp chats, and other business communications in real-time.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, eDiscovery response requirements and reduces risk across the financial industry. TeleMessage captures and records mobile content, including SMS, MMS, voice calls, social media, and WhatsApp Chats from corporate or BYOD mobile phones. Messages are securely and reliably retained within TeleMessage servers or forwarded to an archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD and employer-issued). With our multiple archiving methods, you can always find the right tools or blend for your text message archiving and voice call recording requirements:

TeleMessage offers cross-carrier and international mobile text and calls archiving for Corporate and BYOD phones. Visit www.telemessage.com to learn more about our enterprise mobile archiver’s capabilities or contact ss to try our mobile archiving products today.