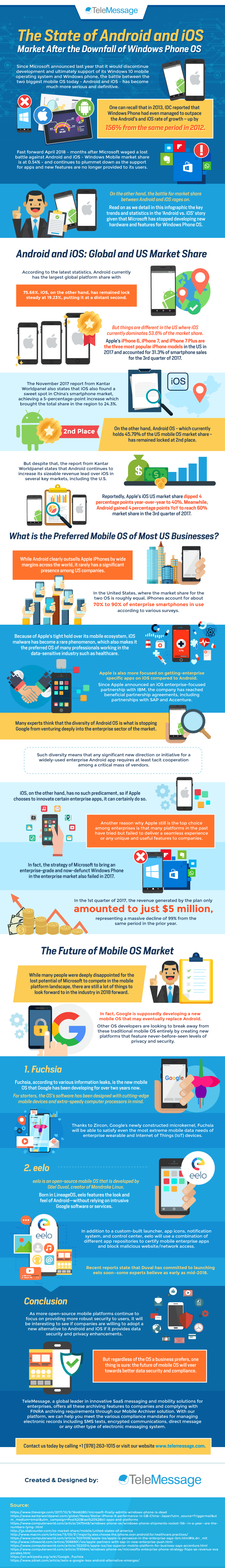

Since Microsoft announced last year that it would discontinue development and ultimately support of its Windows 10 mobile operating system and Windows phone, the battle between the two biggest mobile OS today – Android and iOS – has become much more serious and definitive.

One can recall that in 2013, IDC reported that Windows Phone had even managed to outpace the Android’s and iOS rate of growth – up by 156% from the same period in 2012. Fast forward April 2018 – months after Microsoft waged a lost battle against Android and iOS – Windows Mobile market share is at 0.54% – and continues to plummet down as the support for apps and new features are no longer provided to its users.

On the other hand, the battle for market share between Android and iOS rages on. Read on as we detail in this infographic the key trends and statistics in the ‘Android vs. iOS’ story given that Microsoft has stopped developing new hardware and features for Windows Phone OS.

Android and iOS: Global and US Market Share

Android and iOS: Global and US Market Share

According to the latest statistics, Android currently has the largest global platform share with 75.66%. iOS, on the other hand, has remained lock steady at 19.23%, putting it at a distant second.

But things are different in the US where iOS currently dominates 53.6% of the market share. Apple’s iPhone 6, iPhone 7, and iPhone 7 Plus are the three most popular iPhone models in the US in 2017 and accounted for 31.3% of smartphone sales for the 3rd quarter of 2017. The November 2017 report from Kantar Worldpanel also states that iOS also found a sweet spot in China’s smartphone market, achieving a 5-percentage-point increase which brought the total share in the region to 24.3%.

On the other hand, Android OS – which currently holds 45.79% of the US mobile OS market share – has remained locked at 2nd place. But despite that, the report from Kantar Worldpanel states that Android continues to increase its sizeable revenue lead over iOS in several key markets, including the U.S. Reportedly, Apple’s iOS US market share dipped 4 percentage points year-over-year to 40%. Meanwhile, Android gained 4 percentage points YoY to reach 60% market share in the 3rd quarter of 2017.

What is the Preferred Mobile OS of Most US Businesses?

While Android clearly outsells Apple iPhones by wide margins across the world, it rarely has a significant presence among US companies. in the United States, where the market share for the two OS is roughly equal, iPhones account for about 70% to 90% of enterprise smartphones in use, according to various surveys.

Because of Apple’s tight hold over its mobile ecosystem, iOS malware has become a rare phenomenon, which also makes it the preferred OS of many professionals working in the data-sensitive industry such as healthcare.

Apple is also more focused on getting-enterprise specific apps on iOS compared to Android. Since Apple announced an iOS enterprise-focused partnership with IBM, the company has reached beneficial partnership agreements, including partnerships with SAP and Accenture.

Many experts think that the diversity of Android OS is what is stopping Google from venturing deeply into the enterprise sector of the market. Such diversity means that any significant new direction or initiative for a widely-used enterprise Android app requires at least tacit cooperation among a critical mass of vendors. iOS, on the other hand, has no such predicament, so if Apple chooses to innovate certain enterprise apps, it can certainly do so.

Another reason why Apple still is the top choice among enterprises is that many platforms in the past have tried but failed to deliver a seamless experience or any unique and useful features to companies. In fact, the strategy of Microsoft to bring an enterprise-grade and now-defunct Windows Phone in the enterprise market also failed in 2017. In the 1st quarter of 2017, the revenue generated by the plan only amounted to just $5 million, representing a massive decline of 99% from the same period in the prior year.

The Future of Mobile OS Market

While many people were deeply disappointed for the lost potential of Microsoft to compete in the mobile platform landscape, there are still a lot of things to look forward to in the industry in 2018 forward.

In fact, Google is supposedly developing a new mobile OS that may eventually replace Android. Other OS developers are looking to break away from these traditional mobile OS entirely by creating new platforms that feature never-before-seen levels of privacy and security.

1. Fuchsia

Fuchsia, according to various information leaks, is the new mobile OS that Google has been developing for over two years now. For starters, the OS’s software has been designed with cutting-edge mobile devices and extra-speedy computer processors in mind.

Thanks to Zircon, Google’s newly constructed microkernel, Fuchsia will be able to satisfy even the most extreme mobile data needs of enterprise wearable and Internet of Things (IoT) devices.

2. eelo

eelo is an open-source mobile OS that is developed by Gäel Duval, creator of Mandrake Linux. Born in LineageOS, eelo features the look and feel of Android—without relying on intrusive Google software or services.

In addition to a custom-built launcher, app icons, notification system, and control center, eelo will use a combination of different app repositories to certify mobile enterprise apps and block malicious website/network access. Recent reports state that Duval has committed to launching eelo soon—some experts believe as early as mid-2018.

Conclusion

As more open-source mobile platforms continue to focus on providing more robust security to users, it will be interesting to see if companies are willing to adopt a new alternative to Android and iOS if it provides data security and privacy enhancements. But regardless of the OS a business prefers, one thing is sure: the future of mobile OS will veer towards better data security and compliance.

TeleMessage, a global leader in innovative SaaS messaging and mobility solutions for enterprises, offers all these archiving features to companies and complying with FINRA archiving requirements through our Mobile Archiver solution. With our platform, we can help you meet the various compliance mandates for managing electronic records including SMS texts, encrypted communications, direct message or any other type of electronic messaging system.

Contact us today by calling +1 (978) 263-1015 or visit our website www.telemessage.com.