In our previous post, we discussed the degree of sanctions and fines that Financial Industry Regulation Authority (FINRA) has levied against firms who have failed to establish compliant electronic communications supervisory systems in their business.

As mentioned, there are other key enforcement issues in 2017 aside from electronic communications that FINRA is still closely monitoring in 2018. With all these issues having a direct link on how firms manage and archive electronic records, firms must immediately review their own supervisory systems to ensure that it is aligned with the key priorities of FINRA in 2018.

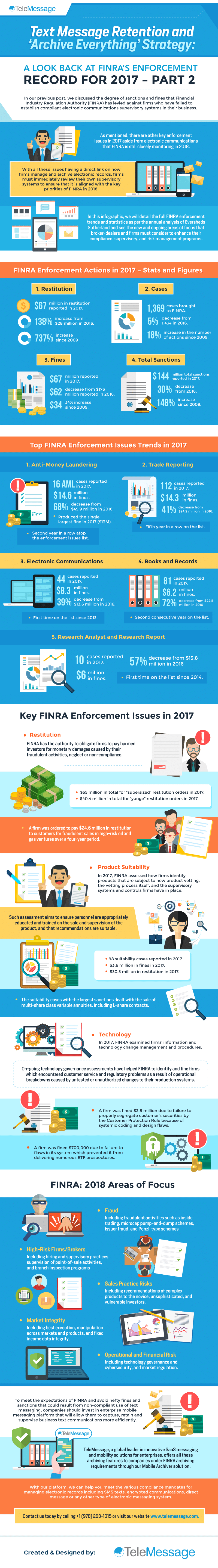

In this infographic, we will detail the full FINRA enforcement trends and statistics as per the annual analysis of Eversheds Sutherland and see the new and ongoing areas of focus that broker-dealers and firms must consider to enhance their compliance, supervisory, and risk management programs.

FINRA Enforcement Actions in 2017 – Stats and Figures

1. Restitution

- $67 million in restitution reported in 2017.

- 138% increase from $28 million in 2016.

- 737% increase since 2009

2. Cases

- 1,369 cases brought to FINRA.

- 5% decrease from 1,434 in 2016.

- 18% increase in the number of actions since 2009.

3. Fines

- $67 million reported in 2017.

- 62% decrease from $176 million reported in 2016.

- 34% increase since 2009.

4. Total Sanctions

- $144 million total sanctions reported in 2017.

- 30% decrease from 2016.

- 148% increase since 2009

Top FINRA Enforcement Issues Trends in 2017

1. Anti-Money Laundering

- 16 AML cases reported in 2017.

- $14.6 million in fines.

- 68% decrease from $45.9 million in 2016.

- Produced the single largest fine in 2017 ($13M).

- Second year in a row atop the enforcement issues list.

2. Trade Reporting

- 112 cases reported in 2017.

- $14.3 million in fines.

- 41% decrease from $24.2 million in 2016.

- Fifth year in a row on the list.

3. Electronic Communications

- 44 cases reported in 2017

- $8.3 million in fines

- 39% decrease from $13.6 million in 2016.

- First time on the list since 2013.

4. Books and Records

- 81 cases reported in 2017.

- $6.2 million in fines

- 72% decrease $22.5 million in 2016

- Second consecutive year on the list.

5. Research Analyst and Research Report

- 10 cases reported in 2017.

- $6 million in fines

- 57% decrease from $13.8 million in 2016

- First time on the list since 2014.

Key FINRA Enforcement Issues in 2017

- Restitution – FINRA has the authority to obligate firms to pay harmed investors for monetary damages caused by their fraudulent activities, neglect or non-compliance.

- $55 million in total for “supersized” restitution orders in 2017.

- $40.4 million in total for “yuuge” restitution orders in 2017.

- A firm was ordered to pay $24.6 million in restitution to customers for fraudulent sales in high-risk oil and gas ventures over a four-year period.

- Product Suitability -In 2017, FINRA assessed how firms identify products that are subject to new product vetting, the vetting process itself, and the supervisory systems and controls firms have in place. Such assessment aims to ensure personnel are appropriately educated and trained on the sale and supervision of the product, and that recommendations are suitable.

- 98 suitability cases reported in 2017.

- $3.6 million in fines in 2017.

- $30.3 million in restitution in 2017.

- The suitability cases with the largest sanctions dealt with the sale of multi-share class variable annuities, including L-share contracts.

- Technology – In 2017, FINRA examined firms’ information and technology change management and procedures. On-going technology governance assessments have helped FINRA to identify and fine firms which encountered customer service and regulatory problems as a result of operational breakdowns caused by untested or unauthorized changes to their production systems.

- A firm was fined $2.8 million due to failure to properly segregate customer’s securities by the Customer Protection Rule because of systemic coding and design flaws.

- A firm was fined $700,000 due to failure to flaws in its system which prevented it from delivering numerous ETF prospectuses.

FINRA: 2018 Areas of Focus

- Fraud – Including fraudulent activities such as inside trading, microcap pump-and-dump schemes, issuer fraud, and Ponzi-type schemes

- High-Risk Firms/Brokers – Including hiring and supervisory practices, supervision of point-of-sale activities, and branch inspection programs

- Sales Practice Risks – Including recommendations of complex products to the novice, unsophisticated, and vulnerable investors.

- Market Integrity – Including best execution, manipulation across markets and products, and fixed income data integrity.

- Operational and Financial Risk – Including technology governance and cybersecurity, and market regulation.

To meet the expectations of FINRA and avoid hefty fines and sanctions that could result from non-compliant use of text messaging, companies should invest in enterprise mobile messaging platform that will allow them to capture, retain and supervise business text communications more efficiently.

TeleMessage, a global leader in innovative SaaS messaging and mobility solutions for enterprises, offers all these archiving features to companies under FINRA archiving requirements through our Mobile Archiver solution. With our platform, we can help you meet the various compliance mandates for managing electronic records including SMS texts, encrypted communications, direct message or any other type of electronic messaging system.

Contact us today by calling +1 (978) 263-1015 or visit our website www.telemessage.com.