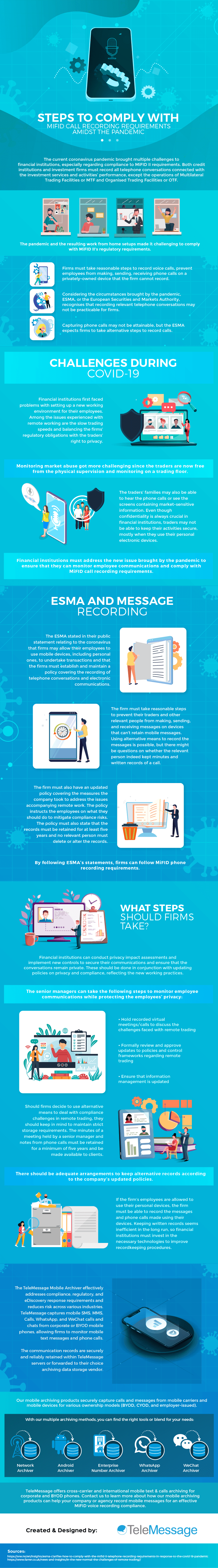

The current coronavirus pandemic brought multiple challenges to financial institutions, especially regarding compliance to MiFID II requirements. Both credit institutions and investment firms must record all telephone conversations connected with the investment services and activities’ performance, except the operations of Multilateral Trading Facilities or MTF and Organised Trading Facilities or OTF. The pandemic and the resulting work from home setups made it challenging to comply with MiFID II’s regulatory requirements.

Firms must take reasonable steps to record voice calls, prevent employees from making, sending, receiving phone calls on a privately-owned device that the firm cannot record. Considering the circumstances brought by the pandemic, ESMA, or the European Securities and Markets Authority, recognises that recording relevant telephone conversations may not be practicable for firms. Capturing phone calls may not be attainable, but the ESMA expects firms to take alternative steps to record calls.

Challenges During COVID-19

Financial institutions first faced problems with setting up a new working environment for their employees. Among the issues experienced with remote working are the slow trading speeds and balancing the firms’ regulatory obligations with the traders’ right to privacy. Monitoring market abuse got more challenging since the traders are now free from the physical supervision and monitoring on a trading floor.

The traders’ families may also be able to hear the phone calls or see the screens containing market-sensitive information. Even though confidentiality is always crucial in financial institutions, traders may not be able to keep their activities secure, mostly when they use their personal electronic devices.

Financial institutions must address the new issue brought by the pandemic to ensure that they can monitor employee communications and comply with MiFID call recording requirements.

ESMA and Message Recording

The ESMA stated in their public statement relating to the coronavirus that firms may allow their employees to use mobile devices, including personal ones, to undertake transactions and that the firms must establish and maintain a policy covering the recording of telephone conversations and electronic communications.

The firm must take reasonable steps to prevent their traders and other relevant people from making, sending, and receiving messages on devices that can’t retain mobile messages. Using alternative means to record the messages is possible, but there might be questions on whether the relevant person indeed kept minutes and written records of a call.

The firm must also have an updated policy covering the measures the company took to address the issues accompanying remote work. The policy instructs the employees on what they should do to mitigate compliance risks. The policy must also state that the records must be retained for at least five years and no relevant person must delete or alter the records.

By following ESMA’s statements, firms can follow MiFID phone recording requirements.

What Steps Should Firms Take?

Financial institutions can conduct privacy impact assessments and implement new controls to secure their communications and ensure that the conversations remain private. These should be done in conjunction with updating policies on privacy and compliance, reflecting the new working practices.

The senior managers can take the following steps to monitor employee communications while protecting the employees’ privacy:

- Hold recorded virtual meetings/calls to discuss the challenges faced with remote trading

- Formally review and approve updates to policies and control frameworks regarding remote trading

- Ensure that information management is updated

Should firms decide to use alternative means to deal with compliance challenges in remote trading, they should keep in mind to maintain strict storage requirements. The minutes of a meeting held by a senior manager and notes from phone calls must be retained for a minimum of five years and be made available to clients. There should be adequate arrangements to keep alternative records according to the company’s updated policies.

If the firm’s employees are allowed to use their personal devices, the firm must be able to record the messages and phone calls made using their devices. Keeping written records seems inefficient in the long run, so financial institutions must invest in the necessary technologies to improve recordkeeping procedures.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, and eDiscovery response requirements and reduces risk across various industries. TeleMessage captures mobile SMS, MMS, Calls, WhatsApp, and WeChat calls and chats from corporate or BYOD mobile phones, allowing firms to monitor mobile text messages and phone calls. The communication records are securely and reliably retained within TeleMessage servers or forwarded to their choice archiving data storage vendor.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for various ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving solutions, you can always find the right tools or blend for your requirements:

TeleMessage offers cross-carrier and international mobile text & calls archiving for corporate and BYOD phones. Contact us to learn more about how our mobile archiving products can help your company or agency record mobile messages for an effective MiFID voice recording compliance.