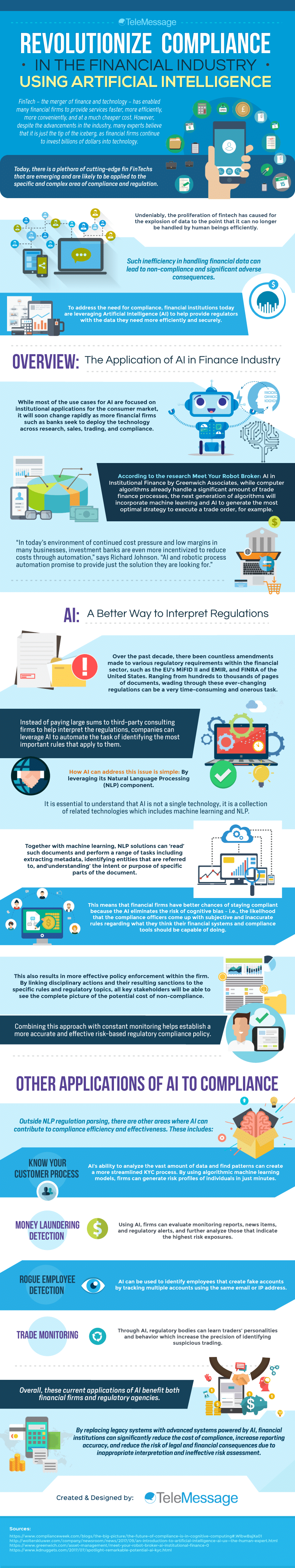

FinTech – the merger of finance and technology – has enabled many financial firms to provide services faster, more efficiently, more conveniently, and at a much cheaper cost. However, despite the advancements in the industry, many experts believe that it is just the tip of the iceberg, as financial firms continue to invest billions of dollars into technology.

Today, there is a plethora of cutting-edge fin FinTechs that are emerging and are likely to be applied to the specific and complex area of compliance and regulation. Undeniably, the proliferation of fintech has caused for the explosion of data to the point that it can no longer be handled by human beings efficiently. Such inefficiency in handling financial data can lead to non-compliance and significant adverse consequences.

To address the need for compliance, financial institutions today are leveraging Artificial Intelligence (AI) to help provide regulators with the data they need more efficiently and securely.

Overview: The Application of AI in Finance Industry

While most of the use cases for AI are focused on institutional applications for the consumer market, it will soon change rapidly as more financial firms such as banks seek to deploy the technology across research, sales, trading, and compliance.

According to the research Meet Your Robot Broker: AI in Institutional Finance by Greenwich Associates, while computer algorithms already handle a significant amount of trade finance processes, the next generation of algorithms will incorporate machine learning and AI to generate the most optimal strategy to execute a trade order, for example.

“In today’s environment of continued cost pressure and low margins in many businesses, investment banks are even more incentivized to reduce costs through automation,” says Richard Johnson. “AI and robotic process automation promise to provide just the solution they are looking for.”

AI: A Better Way to Interpret Regulations

Over the past decade, there been countless amendments made to various regulatory requirements within the financial sector, such as the EU’s MiFID II and EMIR, and FINRA of the United States. Ranging from hundreds to thousands of pages of documents, wading through these ever-changing regulations can be a very time-consuming and onerous task.

Instead of paying large sums to third-party consulting firms to help interpret the regulations, companies can leverage AI to automate the task of identifying the most important rules that apply to them.

How AI can address this issue is simple: By leveraging its Natural Language Processing (NLP) component. It is essential to understand that AI is not a single technology, it is a collection of related technologies which includes machine learning and NLP.

Together with machine learning, NLP solutions can ‘read’ such documents and perform a range of tasks including extracting metadata, identifying entities that are referred to, and ‘understanding’ the intent or purpose of specific parts of the document.

This means that financial firms have better chances of staying compliant because the AI eliminates the risk of cognitive bias – i.e., the likelihood that the compliance officers come up with subjective and inaccurate rules regarding what they think their financial systems and compliance tools should be capable of doing.

This also results in more effective policy enforcement within the firm. By linking disciplinary actions and their resulting sanctions to the specific rules and regulatory topics, all key stakeholders will be able to see the complete picture of the potential cost of non-compliance. Combining this approach with constant monitoring helps establish a more accurate and effective risk-based regulatory compliance policy.

Other Applications of AI to Compliance

Outside NLP regulation parsing, there are other areas where AI can contribute to compliance efficiency and effectiveness. These includes:

- Know Your Customer Process – AI’s ability to analyze the vast amount of data and find patterns can create a more streamlined KYC process. By using algorithmic machine learning models, firms can generate risk profiles of individuals in just minutes.

- Money Laundering Detection – Using AI, firms can evaluate monitoring reports, news items, and regulatory alerts, and further analyze those that indicate the highest risk exposures.

- Rogue Employee Detection -AI can be used to identify employees that create fake accounts by tracking multiple accounts using the same email or IP address.

- Trade Monitoring – Through AI, regulatory bodies can learn traders’ personalities and behavior which increase the precision of identifying suspicious trading.

Overall, these current applications of AI benefit both financial firms and regulatory agencies. By replacing legacy systems with advanced systems powered by AI, financial institutions can significantly reduce the cost of compliance, increase reporting accuracy, and reduce the risk of legal and financial consequences due to inappropriate interpretation and ineffective risk assessment.