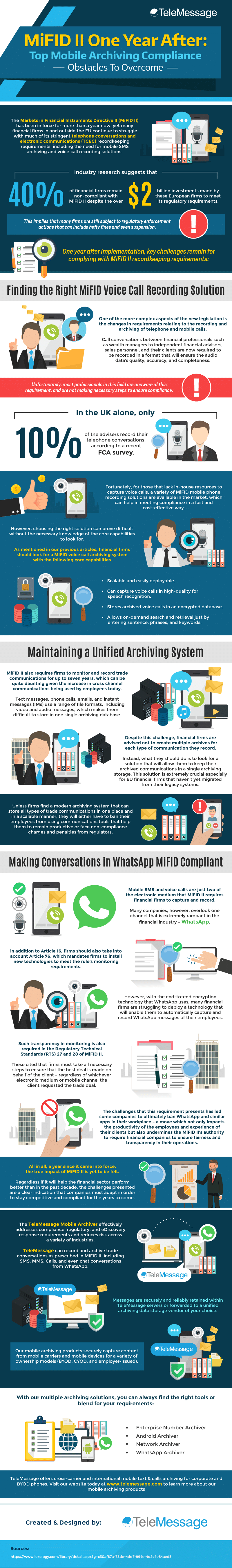

The Markets in Financial Instruments Directive II (MiFID II) has been in force for more than a year now, yet many financial firms in and outside the EU continue to struggle with much of its stringent telephone conversations and electronic communications (TCEC) recordkeeping requirements, including the need for mobile SMS archiving and voice call recording solutions.

Industry research suggests that 40% of financial firms remain non-compliant with MiFID II despite the over $2 billion investments made by these European firms to meet its regulatory requirements. This implies that many firms are still subject to regulatory enforcement actions that can include hefty fines and even suspension.

One year after implementation, key challenges remain for complying with MiFID II recordkeeping requirements:

Finding the Right MiFID Voice Call Recording Solution

One of the more complex aspects of the new legislation is the changes in requirements relating to the recording and archiving of telephone and mobile calls. Call conversations between financial professionals such as wealth managers to independent financial advisors, sales personnel, and their clients are now required to be recorded in a format that will ensure the audio data’s quality, accuracy, and completeness.

Unfortunately, most professionals in this field are unaware of this requirement, and are not making necessary steps to ensure compliance. In the UK alone, only 10% of the advisers record their telephone conversations, according to a recent FCA survey.

Fortunately, for those that lack in-house resources to capture voice calls, a variety of MiFID mobile phone recording solutions are available in the market, which can help in meeting compliance in a fast and cost-effective way.

However, choosing the right solution can prove difficult without the necessary knowledge of the core capabilities to look for. As mentioned in our previous articles, financial firms should look for a MiFID voice call archiving system with the following core capabilities

- Scalable and easily deployable.

- Can capture voice calls in high-quality for speech recognition.

- Stores archived voice calls in an encrypted

- Allows on-demand search and retrieval just by entering sentence, phrases, and

Maintaining a Unified Archiving System

MiFID II also requires firms to monitor and record trade communications for up to seven years, which can be quite daunting given the increase in cross channel communications being used by employees today. Text messages, phone calls, emails, and instant messages (IMs) use a range of file formats, including video and audio messages, which makes them difficult to store in one single archiving database.

Despite this challenge, financial firms are advised not to create multiple archives for each type of communication they record. Instead, what they should do is to look for a solution that will allow them to keep their archived communications in a single archiving storage. This solution is extremely crucial especially for EU financial firms that haven’t yet migrated from their legacy systems.

Unless firms find a modern archiving system that can store all types of trade communications in one place and in a scalable manner, they will either have to ban their employees from using communications tools that help them to remain productive or face non-compliance charges and penalties from regulators.

Making Conversations in WhatsApp MiFID Compliant

Mobile SMS and voice calls are just two of the electronic medium that MiFID II requires financial firms to capture and record. Many companies, however, overlook one channel that is extremely rampant in the financial industry – WhatsApp.

in addition to Article 16, firms should also take into account Article 76, which mandates firms to install new technologies to meet the rule’s monitoring requirements. However, with the end-to-end encryption technology that WhatsApp uses, many financial firms are struggling to deploy a technology that will enable them to automatically capture and record WhatsApp messages of their employees.

Such transparency in monitoring is also required in the Regulatory Technical Standards (RTS) 27 and 28 of MiFID II. These cited that firms must take all necessary steps to ensure that the best deal is made on behalf of the client – regardless of whichever electronic medium or mobile channel the client requested the trade deal.

The challenges that this requirement presents has led some companies to ultimately ban WhatsApp and similar apps in their workplace – a move which not only impacts the productivity of the employees and experience of their clients but also undermines the MiFID II’s authority to require financial companies to ensure fairness and transparency in their operations.

All in all, a year since it came into force, the true impact of MiFID II is yet to be felt. Regardless if it will help the financial sector perform better than in the past decade, the challenges presented are a clear indication that companies must adapt in order to stay competitive and compliant for the years to come.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, and eDiscovery response requirements and reduces risk across a variety of industries. TeleMessage can record and archive trade conversations as prescribed in MiFID II, including SMS, MMS, Calls, and even chat conversations from WhatsApp. Messages are securely and reliably retained within TeleMessage servers or forwarded to a unified archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving solutions, you can always find the right tools or blend for your requirements:

TeleMessage offers cross-carrier and international mobile text & calls archiving for corporate and BYOD phones. Visit our website today at www.telemessage.com to learn more about our mobile archiving products.