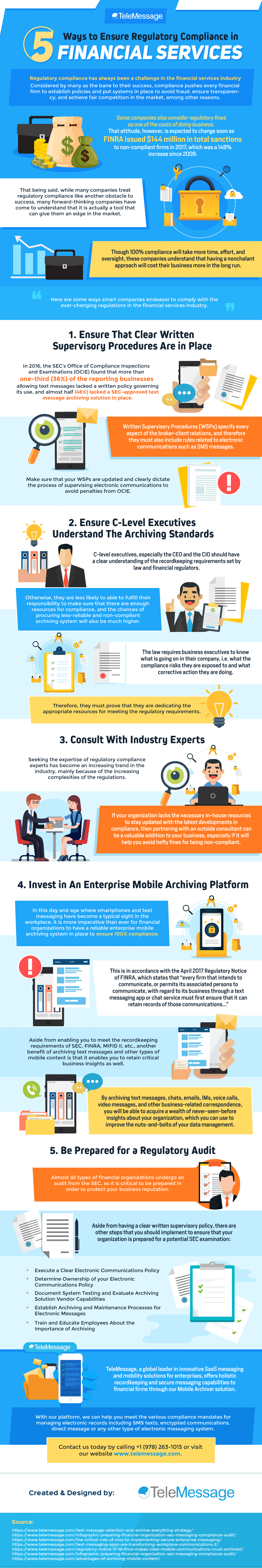

Regulatory compliance has always been a challenge in the financial services industry. Considered by many as the bane to their success, compliance pushes every financial firm to establish policies and put systems in place to avoid fraud, ensure transparency, and achieve fair competition in the market, among other reasons.

Some companies also consider regulatory fines as one of the costs of doing business. That attitude, however, is expected to change soon as FINRA issued $144 million in total sanctions to non-compliant firms in 2017, which was a 148% increase since 2009.

That being said, while many companies treat regulatory compliance like another obstacle to success, many forward-thinking companies have come to understand that it is actually a tool that can give them an edge in the market. Though 100% compliance will take more time, effort, and oversight, these companies understand that having a nonchalant approach will cost their business more in the long run.

Here are some ways smart companies endeavor to comply with the ever-changing regulations in the financial services industry.

1. Ensure That Clear Written Supervisory Procedures Are in Place

In 2016, the SEC’s Office of Compliance Inspections and Examinations (OCIE) found that more than one-third (36%) of the reporting businesses allowing text messages lacked a written policy governing its use, and almost half (48%) lacked a SEC-approved text message archiving solution in place.

Written Supervisory Procedures (WSPs) specify every aspect of the broker-client relations, and therefore they must also include rules related to electronic communications such as SMS messages. Make sure that your WSPs are updated and clearly dictate the process of supervising electronic communications to avoid penalties from OCIE.

2. Ensure C-Level Executives Understand The Archiving Standards

C-level executives, especially the CEO and the CIO should have a clear understanding of the recordkeeping requirements set by law and financial regulators.

Otherwise, they are less likely to able to fulfill their responsibility to make sure that there are enough resources for compliance, and the chances of procuring less-reliable and non-compliant archiving system will also be much higher.

The law requires business executives to know what is going on in their company, i.e. what the compliance risks they are exposed to and what corrective action they are doing. Therefore, they must prove that they are dedicating the appropriate resources for meeting the regulatory requirements.

3. Consult With Industry Experts

Seeking the expertise of regulatory compliance experts has become an increasing trend in the industry, mainly because of the increasing complexities of the regulations. If your organization lacks the necessary in-house resources to stay updated with the latest developments in compliance, then partnering with an outside consultant can be a valuable addition to your business, especially if it will help you avoid hefty fines for being non-compliant.

4. Invest in An Enterprise Mobile Archiving Platform

In this day and age where smartphones and text messaging have become a typical sight in the workplace, it is more imperative than ever for financial organizations to have a reliable enterprise mobile archiving system in place to ensure 100% compliance.

This is in accordance with the April 2017 Regulatory Notice of FINRA, which states that “every firm that intends to communicate, or permits its associated persons to communicate, with regard to its business through a text messaging app or chat service must first ensure that it can retain records of those communications…”

Aside from enabling you to meet the recordkeeping requirements of SEC, FINRA, MiFID II, etc., another benefit of archiving text messages and other types of mobile content is that it enables you to retain critical business insights as well.

By archiving text messages, chats, emails, IMs, voice calls, video messages, and other business-related correspondence, you will be able to acquire a wealth of never-seen-before insights about your organization, which you can use to improve the nuts-and-bolts of your data management.

5. Be Prepared for a Regulatory Audit

Almost all types of financial organizations undergo an audit from the SEC, so it is critical to be prepared in order to protect your business reputation. Aside from having a clear written supervisory policy, there are other steps that you should implement to ensure that your organization is prepared for a potential SEC examination:

- Execute a Clear Electronic Communications Policy

- Determine Ownership of your Electronic Communications Policy

- Document System Testing and Evaluate Archiving Solution Vendor Capabilities

- Establish Archiving and Maintenance Processes for Electronic Messages

- Train and Educate Employees About the Importance of Archiving

TeleMessage, a global leader in innovative SaaS messaging and mobility solutions for enterprises, offers holistic recordkeeping and secure messaging capabilities to financial firms through our Mobile Archiver solution. With our platform, we can help you meet the various compliance mandates for managing electronic records including SMS texts, encrypted communications, direct message or any other type of electronic messaging system.

Contact us today by calling +1 (978) 263-1015 or visit our website www.telemessage.com.