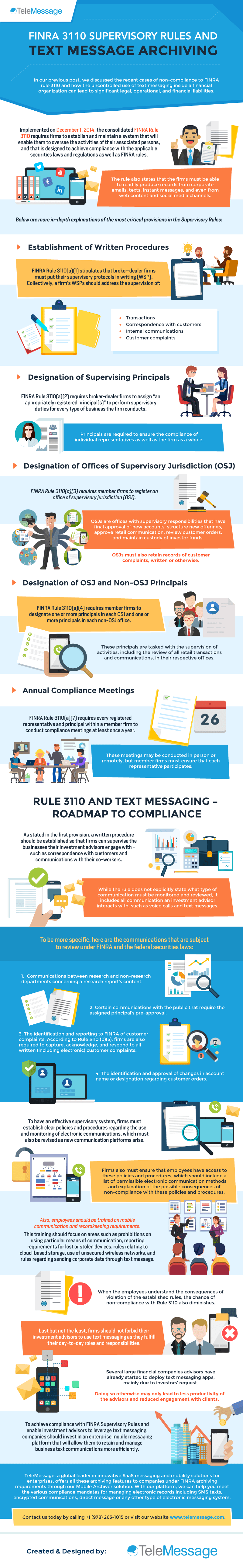

In our previous post, we have discussed the recent cases of non-compliance to FINRA rule 3110 and how the uncontrolled use of text messaging inside a financial organization can lead to great deal of legal, operational, and financial liabilities.

Implemented on December 1, 2014, the consolidated FINRA Rule 3110 requires firms to establish and maintain a system that will enable firms to oversee the activities of its associated persons, and that is designed to achieve compliance with the applicable securities laws and regulations as well as FINRA text message archiving requirements. The rule also states that the firms must be able to readily produce records from corporate emails, texts, instant messages, and even from web content and social media channels.

Below are more in-depth explanations of the most critical provisions in the Supervisory Rules:

- Establishment of Written Procedures

FINRA Rule 3110(a)(1) stipulates that broker-dealer firms must put their supervisory protocols in writing (WSP). Collectively, a firm’s WSPs should address the supervision of

- Transactions;

- Correspondence with Customers

- Internal Communications

- Customer complaints

- Designation of Supervising Principals

FINRA Rule 3110(a)(2) requires broker-dealer firms to assign “an appropriately registered principal(s)” to perform supervisory duties for every type of business the firm conducts. Principals are required to ensure the compliance of individual representatives as well as the firm as a whole.

- Designation of Offices of Supervisory Jurisdiction (OSJ)

FINRA Rule 3110(a)(3) requires member firms to register an office of supervisory jurisdiction (OSJ). OSJs are offices with supervisory responsibilities that have final approval of new accounts, structure new offerings, approve retail communication, review customer orders, and maintain custody of investor funds. OSJs must also retain records of customer complaints, written or otherwise.

- Designation of OSJ and Non-OSJ Principals

FINRA Rule 3110(a)(4) requires member firms to designate one or more principals in each OSJ and one or more principals in each non-OSJ office. These principals are tasked with the supervision of activities, including the review of all retail transactions and communications, in their respective offices

- Annual Compliance Meetings

FINRA Rule 3110(a)(7) requires every registered representative and principal within a member firm to conduct compliance meetings at least once a year. These meetings may be conducted in person or remotely, but member firms must ensure that each representative participates.

Rule 3110 and Text Messaging – Roadmap to Compliance

As stated in the first provision, a written procedure should be established so that firms can supervise: the businesses their investment advisors engage with – such as correspondence with customers; communications with their co-workers; and compliant FINRA text message archiving. While the rule does not explicitly state what type of communication must be monitored and reviewed, it includes all communication an investment advisor interacts with, such as voice calls and text messages.

To be more specific, here are the communications that are subject to review under FINRA retention requirements and the federal securities laws:

1. Communications between research and non-research departments concerning a research report’s content.

2. Certain communications with the public that require the assigned principal’s pre-approval.

3. The identification and reporting to FINRA of customer complaints. According to Rule 3110 (b)(5), firms are also required to capture, acknowledge, and respond to all written (including electronic) customer complaints.

4. The identification and approval of changes in account name or designation regarding customer orders.

To have an effective supervisory system, firms must establish clear policies and procedures regarding the use and monitoring of electronic communications, which must also be revised as new communication platforms arise. Firms also must ensure that employees have access to these policies and procedures, which should include a list of permissible electronic communication methods and explanation of the possible consequences of non-compliance with these policies and procedures.

Also, employees should be trained on mobile communication and recordkeeping requirements. This training should focus on areas such as prohibitions on using particular means of communication, reporting requirements for lost or stolen devices, rules relating to cloud-based storage, use of unsecured wireless networks, and rules regarding sending corporate data through text message. When the employees understand the consequences of violation of the established rules, the chance of non-compliance to Rule 3110 also diminishes.

Last but not the least, firms should not forbid their investment advisors to use text messaging as they fulfill their day-to-day roles and responsibilities. Several large financial companies have already started to deploy text messaging apps to their herd of advisors, mainly due to investors’ request. Doing so otherwise may only lead to less productivity of the advisors and reduced engagement from clients.

To achieve compliance with FINRA Supervisory Rules and enable investment advisors to leverage text messaging, companies should invest in enterprise mobile messaging platform that will allow them to retain and manage business text communications more efficiently.

TeleMessage, a global leader in innovative SaaS messaging and mobility solutions for enterprises, offers all these archiving features to companies under FINRA text message archiving requirements through our Mobile Archiver solution. With our platform, we can help you meet the various compliance mandates for managing electronic records including SMS texts, encrypted communications, direct message or any other type of electronic messaging system.

Contact us today by calling +1 (978) 263-1015 or visit our website www.telemessage.com.