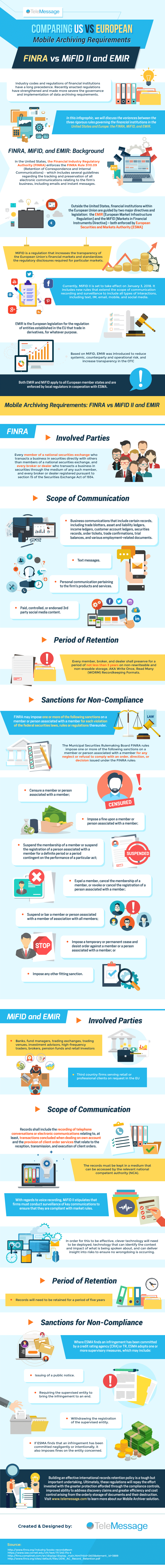

Industry codes and regulations of financial institutions have a long precedence. Recently enacted regulations have strengthened and made more severe the governance and implementation of data archiving requirements.

In this infographic, we will discuss the variances between the three rigorous rules governing the financial institutions in the United States and Europe: the FINRA, MiFID, and EMIR.

FINRA, MiFID, and EMIR: Background

In the United States, the Financial Industry Regulatory Authority (FINRA) enforces the FINRA Rule 3110.09 (Retention of Correspondence and Internal Communications) – which includes several guidelines regarding the tracking and preservation of all electronic communications relating to the firm’s business, including emails and instant messages.

Outside the United States, financial institutions within the European Union are guided by two major directives and legislation: the EMIR (European Market Infrastructure Regulation) and the MiFID (Markets in Financial Instruments Directive) – both enforced by European Securities and Markets Authority (ESMA)

MiFID is a regulation that increases the transparency of the European Union’s financial markets and standardizes the regulatory disclosures required for particular markets. Currently, MiFID II is set to take effect on January 3, 2018. It includes new rules that extend the scope of communication recording and surveillance to include all types of interactions, including text, IM, email, mobile, and social media.

EMIR is the European legislation for the regulation of entities established in the EU that trade in derivatives, for whatever purpose. Based on MiFID, EMIR was introduced to reduce systemic, counterparty and operational risk, and increase transparency in the OTC derivatives market.

Both EMIR and MiFID apply to all European member states and are enforced by local regulators in cooperation with ESMA.

Mobile Archiving Requirements: FINRA vs MiFID II and EMIR

FINRA

Involved Parties

Every member of a national securities exchange who transacts a business in securities directly with others than members of a national securities exchange, and every broker or dealer who transacts a business in securities through the medium of any such member, and every broker or dealer registered pursuant to section 15 of the Securities Exchange Act of 1934.

Scope of Communication

- Business communications that include certain records, including trade blotters, asset and liability ledgers, income ledgers, customer account ledgers, securities records, order tickets, trade confirmations, trial balances, and various employment-related documents

- Text messages.

- Personal communication pertaining to the firm’s products and services.

- Paid, controlled, or endorsed 3rd party social media content.

Period of Retention

Every member, broker, and the dealer shall preserve for a period of not less than 3 years on non-rewriteable and non-erasable storage, AKA Write Once, Read Many (WORM) Recordkeeping Formats.

Sanctions for Non-Compliance

FINRA may impose one or more of the following sanctions on a member or person associated with a member for each violation of the federal securities laws, rules or regulations thereunder, the rules of the Municipal Securities Rulemaking Board, or FINRA rules, or may impose one or more of the following sanctions on a member or person associated with a member for any neglect or refusal to comply with an order, direction, or decision issued under the FINRA rules:

- Censure a member or person associated with a member;

- Impose a fine upon a member or person associated with a member;

- Suspend the membership of a member or suspend the registration of a person associated with a member for a definite period or a period contingent on the performance of a particular act;

- Expel a member, cancel the membership of a member, or revoke or cancel the registration of a person associated with a member;

- Suspend or bar a member or person associated with a member of association with all members;

- Impose a temporary or permanent cease and desist order against a member or a person associated with a member; or

- Impose any other fitting sanction.

MiFID and EMIR

Involved Parties

- Banks, fund managers, trading exchanges, trading venues, investment advisors, high-frequency traders, brokers, pension funds and retail investors

- Third country firms serving retail or professional clients on request in the EU

Scope of Communication

MiFID mobile recordings must include the recording of telephone conversations or electronic communications relating to, at least, transactions concluded when dealing on own account and the provision of client order services that relate to the reception, transmission, and execution of client orders.

The records must be kept in a medium that can be accessed by the relevant national competent authority (NCA).

With regards to voice recording, MiFID II stipulates that firms must conduct surveillance of key communications to ensure that they are compliant with market rules. In order for this to be effective, clever technology will need to be deployed; technology that can identify the context and impact of what is being spoken about, and can deliver insight into risks to ensure no wrongdoing is occurring.

Period of Retention

- Records will need to be retained for a period of five years.

Sanctions for Non-Compliance

Where ESMA finds an infringement has been committed by a credit rating agency (CRA) or TR, ESMA adopts one or more supervisory measures, which may include:

- Issuing of a public notice.

- Requiring the supervised entity to bring the infringement to an end.

- Withdrawing the registration of the supervised entity.

- If ESMA finds that an infringement has been committed negligently or intentionally, it also imposes fines on the entity concerned.

Building an effective international records retention policy is a tough but important exercise. Ultimately, these regulations will repay the effort invested with the greater protection afforded through the compliance controls, improved ability to address discovery claims and greater efficiency and cost control arising from the orderly storage of documents and their destruction.