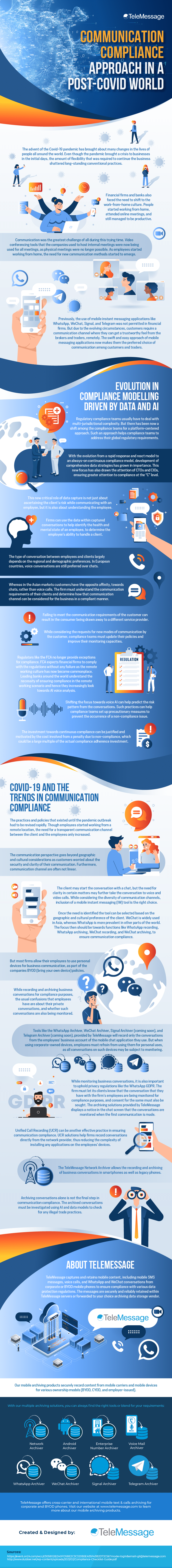

The advent of the Covid-19 pandemic has brought about many changes in the lives of people all around the world. Even though the pandemic brought a crisis to businesses in the initial days, the amount of flexibility that was required to continue the business shattered long-standing conventional practices. Financial firms and banks also faced the need to shift to the work-from-home culture. People started working from home, attended online meetings, and still managed to be productive.

Communication was the greatest challenge of all during this trying time. Video conferencing tools that the companies used to host internal meetings were now being used for all meetings, as physical meetings were no longer possible. As employees started working from home, the need for new communication methods started to emerge. Previously, the use of mobile instant messaging applications like WhatsApp, WeChat, Signal, and Telegram was not permitted in financial firms. But due to the evolving circumstances, customers require a communication channel where they can get a trustworthy feel from the brokers and traders, remotely. The swift and easy approach of mobile messaging applications now makes them the preferred choice of communication among customers and traders.

Evolution in compliance modelling driven by data and AI

Regulatory compliance teams usually have to deal with multi-jurisdictional complexity. But there has been now a shift among the compliance teams for a platform-centered approach. Such an approach helps compliance teams to address their global regulatory requirements. With the evolution from a rapid response and react model to an always-on continuous compliance model, development of comprehensive data strategies has grown in importance. This new focus has also drawn the attention of CTOs and CIOs, ensuring greater attention to compliance at the “C” level.

This new critical role of data capture is not just about ascertaining the client’s risk while communicating with an employee, but it is also about understanding the employee. Firms can use the data within captured conversations to help identify the health and mental state of an employee, to determine the employee’s ability to handle a client.

The type of conversation between employees and clients largely depends on the regional and demographic preferences. In European countries, voice conversations are still preferred over chats. Whereas in the Asian markets customers have the opposite affinity, towards chats, rather than voice calls. The firm must understand the communication requirements of their clients and determine how that communication channel can be considered for the business in a compliant manner. Failing to meet the communication requirements of the customer can result in the consumer being drawn away to a different service provider.

While considering the requests for new modes of communication by the customer, compliance teams must update their policies and improve their monitoring capacities. Regulators like the FCA no longer provide exceptions for compliance. FCA expects financial firms to comply with the regulations without any failure as the remote working culture has now become commonplace. Leading banks around the world understand the necessity of ensuring compliance in the remote working scenario and hence they increasingly look towards AI voice analysis. Shifting the focus towards voice AI can help predict the risk pattern from the conversations. Such practices can help compliance teams set up precautionary measures to prevent the occurrence of a non-compliance issue. The investment towards continuous compliance can be justified and motivated by the cost involved from a penalty due to non-compliance, which could be a large multiple of the actual compliance adherence investment.

Covid-19 and the trends in communication compliance

The practices and policies that existed until the pandemic outbreak had to be revised rapidly. Though employees started working from a remote location, the need for a transparent communication channel between the client and the employees only increased. The communication perspective goes beyond geographic and cultural considerations as customers worried about the security and clarity of their communication. Furthermore, communication channel are often not linear. The client may start the conversation with a chat, but the need for clarity in certain matters may further take the conversation to voice and video calls. While considering the diversity of communication channels, inclusion of a mobile instant messaging (IM) tool is the right choice.

Once the need is identified the tool can be selected based on the geographic and cultural preference of the client. WeChat is widely used in Asia, whereas WhatsApp is more prevalent in other parts of the world. The focus then should be towards functions like WhatsApp recording, WhatsApp archiving, WeChat recording, and WeChat archiving, to ensure communication compliance.

But most firms allow their employees to use personal devices for business communication, as part of the companies BYOD (bring your own device) policies. While recording and archiving business conversations for compliance purposes, the usual confusions that employees have are about their private conversations, and whether such conversations are also being monitored. Tools like the WhatsApp Archiver, WeChat Archiver, Signal Archiver (coming soon), and Telegram Archiver (coming soon), provided by TeleMessage will record only the conversations from the employees’ business account of the mobile chat application they use. But when using corporate-owned devices, employees must refrain from using them for personal uses, as all conversations on such devices may be subject to monitoring.

While monitoring business conversations, it is also important to uphold privacy regulations like the WhatsApp GDPR. The firm must let its clients know that the conversation that they have with the firm’s employees are being monitored for compliance purposes, and consent for the same must also be sought. The archiving solutions provided by TeleMessage displays a notice in the chat screen that the conversations are monitored when the first communication is made.

Unified Call Recording (UCR) can be another effective practice in ensuring communication compliance. UCR solutions help firms record conversations directly from the network provider, thus reducing the complexity of installing any applications on the employees’ devices. The TeleMessage Network Archiver allows the recording and archiving of business conversations in smartphones as well as legacy phones.

Archiving conversations alone is not the final step in communication compliance. The archived conversations must be investigated using AI and data models to check for any illegal trade practices.

About TeleMessage

TeleMessage captures and retains mobile content, including mobile SMS messages, voice calls, and WhatsApp and WeChat conversations from corporate or BYOD mobile phones to ensure compliance with various data protection regulations. The messages are securely and reliably retained within TeleMessage servers or forwarded to your choice archiving data storage vendor.

Our mobile archiving products securely record content from mobile carriers and mobile devices for various ownership models (BYOD, CYOD, and employer-issued). With our multiple archiving solutions, you can always find the right tools or blend for your requirements:

- Network Archiver

- Enterprise Number Archiver

- Android Archiver

- WhatsApp Archiver

- WeChat Archiver

- Signal Archiver

- Telegram Archiver

TeleMessage offers cross-carrier and international mobile text & calls archiving for corporate and BYOD phones. Visit our website at www.telemessage.com to learn more about our mobile archiving products.